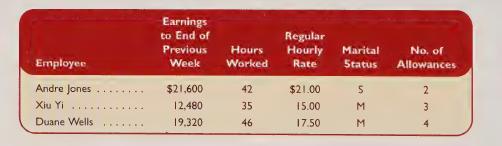

Merle Perkins operates Al Auto Repair. Information on his three employees for the payroll period (week) ending

Question:

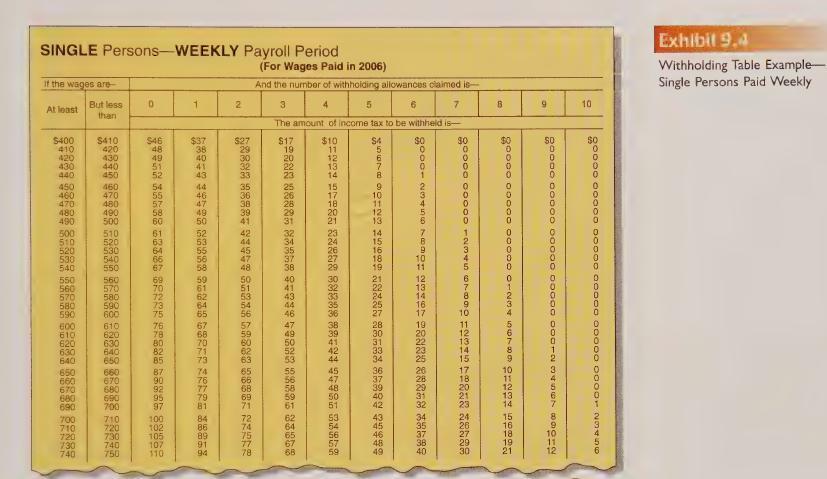

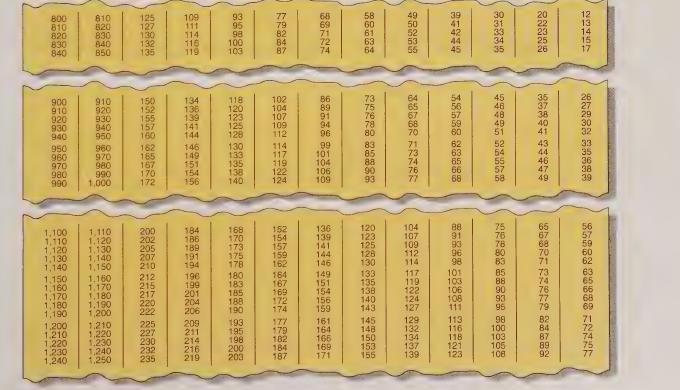

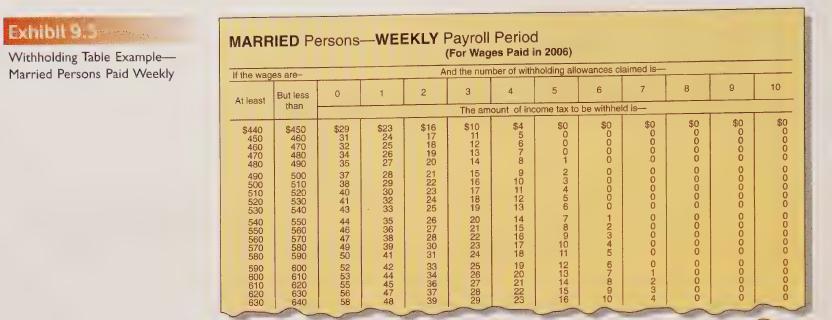

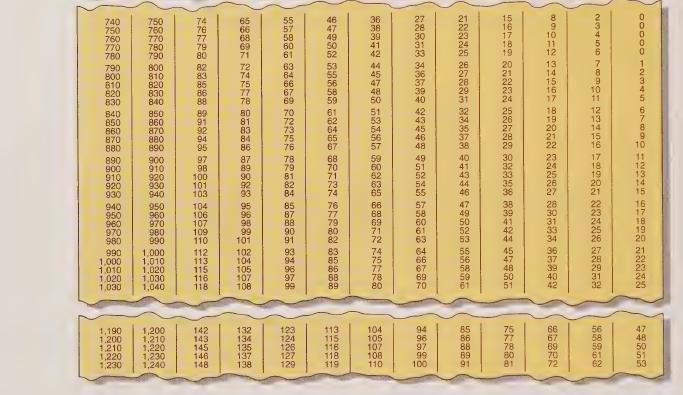

Merle Perkins operates Al Auto Repair. Information on his three employees for the payroll period (week) ending June 1, 2007, is provided below. Each employee receives one and one-half times the normal hourly pay rate for any hour worked beyond 40 in a week. The FICA Social Security tax rate is 6.2% on the first \($94,200\) of each employee’s gross pay and the FICA Medicare tax rate is 1.45% on all of this week’s wages paid to each employee. Federal income tax withholdings are computed from withholding tables and state income tax withholdings are assumed to be 8% of the amount withheld for federal income tax. (Use the withholding tables in Exhibits 9.4 and 9.5.)

Required

I. Enter each employee’s name, year-to-date earnings before this pay period, marital status, regular hourly rate, hours worked, and number of withholding allowances in a payroll register. Hours worked beyond 40 are considered overtime hours.

2. Compute the regular, overtime, and total gross pay for each employee for this pay period. Enter these amounts in the payroll register.

3. Compute the amounts of FICA taxes to be withheld from each employee’s pay and enter these amounts in the payroll register.

4. Determine the amount of federal income tax to withhold from each employee’s gross pay. Use the withholding tables in Exhibits 9.4 and 9.5. Enter these amounts in the payroll register.

5. Determine the amount of state income tax to withhold from each employee’s gross pay. Enter these amounts in the payroll register.

6. Compute each employee’s net pay and enter it into the payroll register.

7. Total the payroll register.

Step by Step Answer:

College Accounting Ch 1-14

ISBN: 9781260904314

1st Edition

Authors: John Wild, Vernon Richardson, Ken Shaw