The payroll records of Swift Company provided the following data for the weekly pay period ended December

Question:

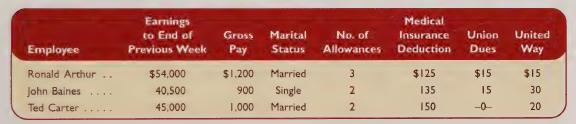

The payroll records of Swift Company provided the following data for the weekly pay period ended December 7:

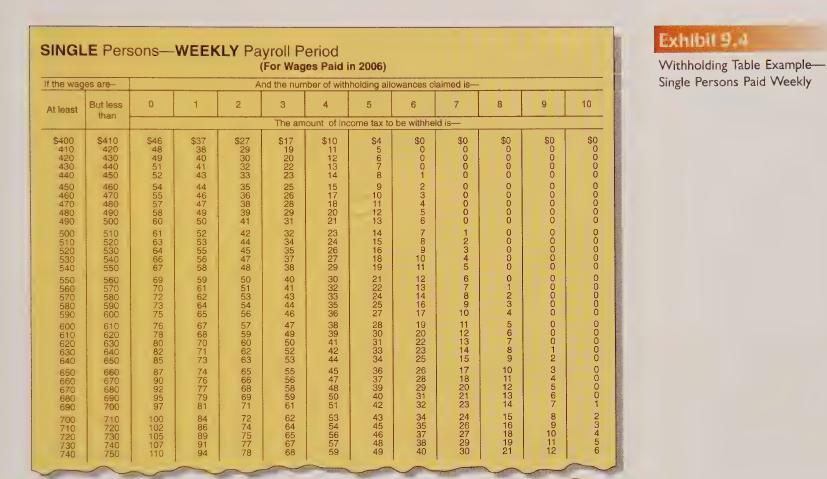

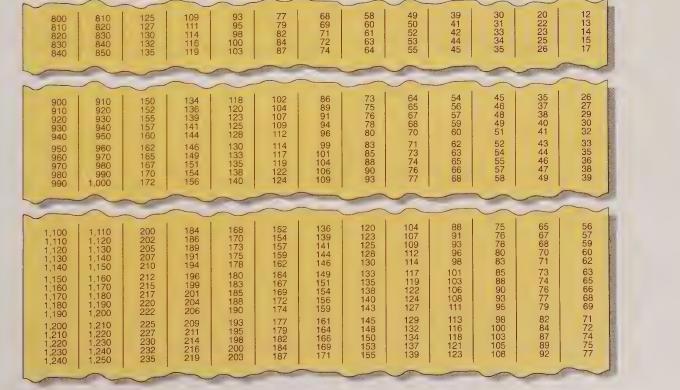

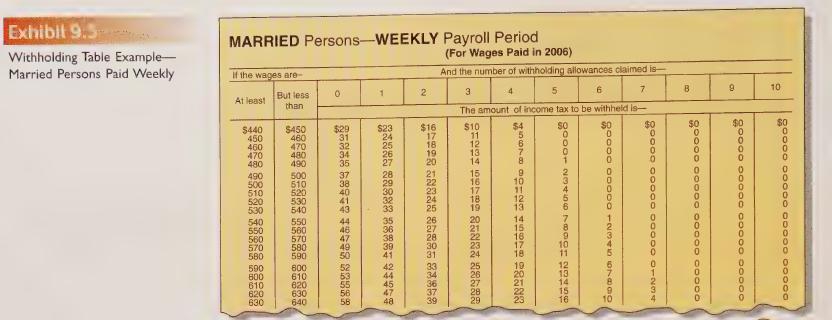

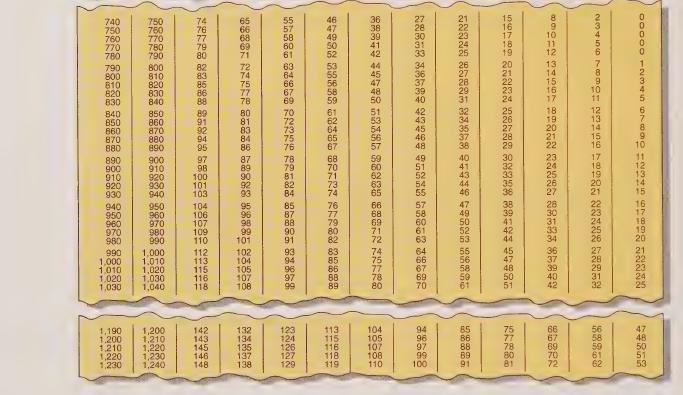

The FICA Social Security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week’s wages paid to each employee. The state income tax equals 8 percent of the amount withheld for federal income tax purposes. (Use the withholding tables in Exhibits 9.4 and 9.5.)

Required

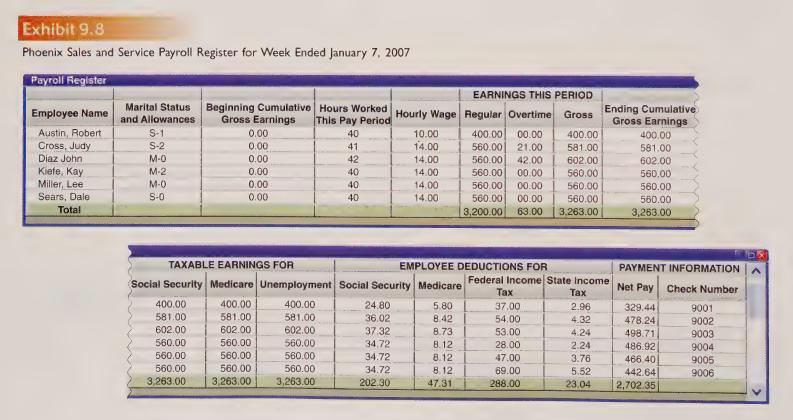

1. Prepare a payroll register similar to that in Exhibit 9.8 for Swift Company for the pay period ending December 7. Your payroll register should have columns for employee name, gross pay, federal income tax withheld, state income tax withheld, Social Security tax, Medicare tax, and deductions for medical insurance, union dues, and United Way contributions, and net pay.

2. Prepare the journal entry to record the December 7 payroll.

3. Prepare the journal entry to pay the December 7 payroll. Swift Company does not use a special payroll bank account.

Step by Step Answer:

College Accounting Ch 1-14

ISBN: 9781260904314

1st Edition

Authors: John Wild, Vernon Richardson, Ken Shaw