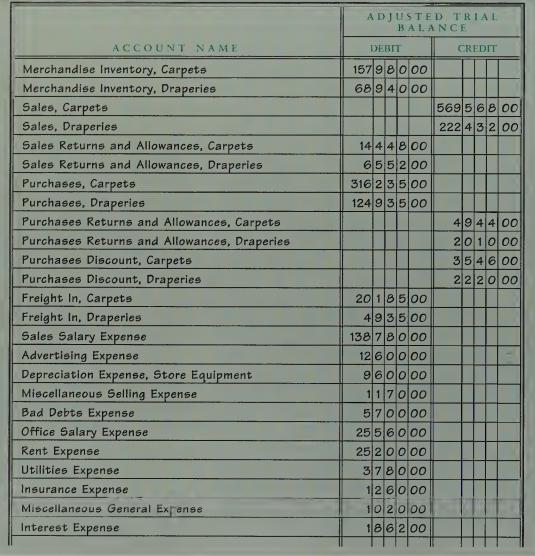

Modern Decorators is a sole proprietorship. After the firm has recorded adjustments, it has the balances shown

Question:

Modern Decorators is a sole proprietorship. After the firm has recorded adjustments, it has the balances shown in the work sheet on page 986 for revenue and expense accounts and merchandise inventories for its two depart¬

ments on December 31, the end of the fiscal year. The values of merchandise inventory on January 1 (beginning) are: carpets, $146,130; draperies, $72,420.

Essential data for direct expenses (and sources of figures) are as follows:

a. Sales Salary Expense (sales personnel work in one department only) is allo¬

cated as follows: carpets, $97,140; draperies, $41,640.

b. Advertising: newspaper advertising is allocated as follows: carpets, $10,080;

draperies, $2,520.

c. Depreciation: Depreciation of store equipment is apportioned on the basis of the average cost of equipment in each department. The average cost of store equipment is $15,000 for carpets and $5,000 for draperies.

d. Bad Debts Expense: Department managers are responsible for granting credit on net sales made by their respective departments. Bad Debts Expense is alio cated as follows: carpets, $4,104; draperies, $1,596

Instructions Prepare an income statement to show each department’s departmental margin.

Problem Set B

Step by Step Answer:

College Accounting Chapters 1-26

ISBN: 9780395796993

6th Edition

Authors: Douglas J. McQuaig, Patricia A. Bille