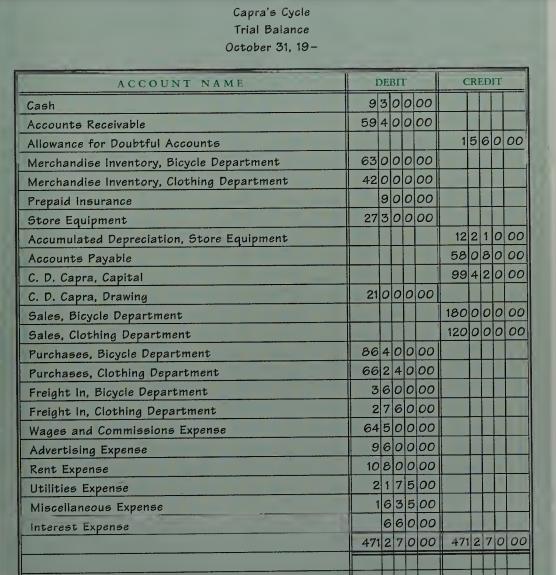

Capras Cycle, a sole proprietorship, has two departments, P.0.2 bicycle and clothing. The trial balance as of

Question:

Capra’s Cycle, a sole proprietorship, has two departments, P.0.2 bicycle and clothing. The trial balance as of October 31, the end of the fiscal year, is shown on page 985.

The data for the adjustments are as follows:

a.-d. Merchandise inventories, October 31, the end of the fiscal period: bicycle department, $60,000; clothing department, $36,000

e. Depreciation of store equipment for the year, $7,230

f. Estimated uncollectible customer charge accounts (based on a percentage of charge sales), $2,190 g. Insurance expired, $585 h. Accrued wages and commissions, $555 i. Accrued interest payable, $216 The bases for apportioning expenses to the two departments are as follows:

• Wages and Commissions Expense (time sheets): bicycle department, $45,540;

clothing department, $19,515

• Advertising Expense (space): bicycle department, $7,680; clothing department,

$1,920

• Depreciation Expense (equipment ledger): bicycle department, $5,061; clothing department, $2,169

• Rent Expense, Utilities Expense, Miscellaneous Expense, Bad Debts Expense, Insurance Expense (sales): bicycle department, 60 percent; clothing depart¬

ment, 40 percent

Instructions Complete the work sheet.

Step by Step Answer:

College Accounting Chapters 1-26

ISBN: 9780395796993

6th Edition

Authors: Douglas J. McQuaig, Patricia A. Bille