Office Supplies Expense was debited for a total of ($425) during the period. An inventory taken at

Question:

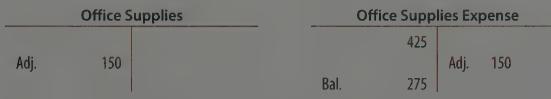

Office Supplies Expense was debited for a total of \($425\) during the period. An inventory taken at the end of the period shows that supplies on hand amounted to \($150.\) The following adjusting entry is made for supplies on hand:

As shown in the T accounts below, after this entry is posted, the office supplies expense account has a debit balance of \($275.\) This amount is reported on the income statement as an operating expense. The office supplies account has a debit balance of \($150.\) It is reported on the balance sheet as a current asset.

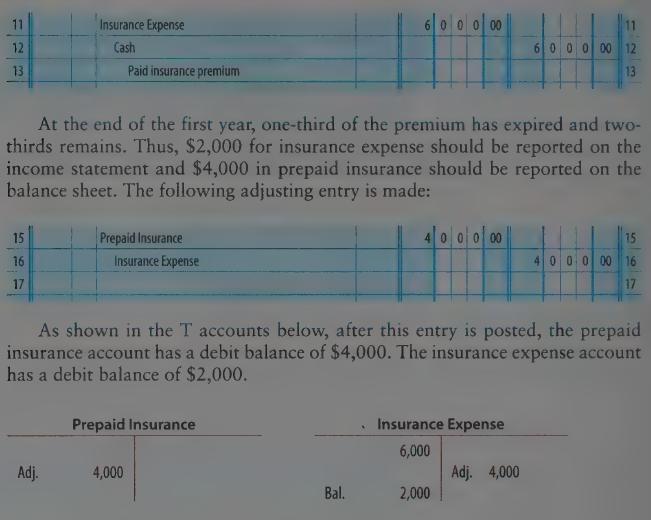

Let’s consider another example of the use of the expense method. The following entry was made for the payment of \($6,000\) for a three-year insurance policy:

The asset and expense methods of accounting for prepaid expenses give the same final result. In the asset method, the prepaid item is first debited to an asset account. At the end of each period, the amount consumed is debited to an expense account. In the expense method, the original amount is debited to an expense account. At the end of each accounting period, the portion not consumed is debited to an asset account.

Step by Step Answer: