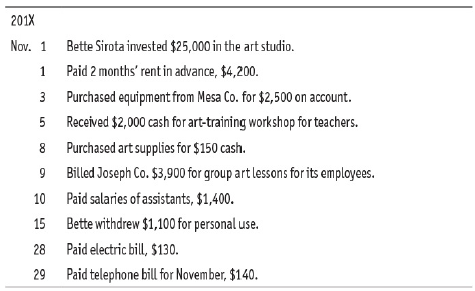

On November 1, 201X, Bette Sirota opened Bette?s Art Studio. The following transactions occurred in November. Your

Question:

On November 1, 201X, Bette Sirota opened Bette?s Art Studio. The following transactions occurred in November.

Your tasks are to do the following:

1. Set up a ledger based on the following chart of accounts using fourcolumn accounts.

2. Journalize (journal is page 1) and post the November journal entries.

3. Prepare a trial balance as of November 30, 201X.

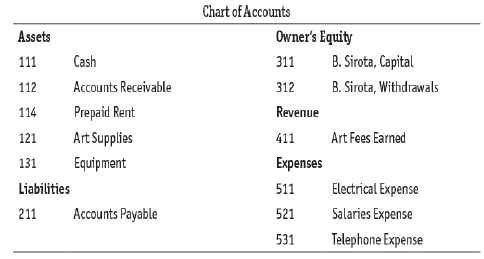

The chart of accounts for Bette?s Art Studio is as follows:

Chart of Accounts Assets Owner's Equity 111 Cash 311 B. Sirota, Capital 112 Accounts Receivable 312 B. Sirota, Withdrawals 114 Prepaid Rent Revenue 121 Art Supplies 411 Art Fees Earned 131 Equipment Expenses Liabilities 511 Electrical Expense 211 Accounts Payable 521 Salaries Expense 531 Telephone Expense

Step by Step Answer:

1 2 BETTESART STUDIO GENERAL JOURNAL PAGE 1 Date 201X Account Titles and Description PR Dr Cr Nov 1 Cash 111 25 0 0 0 00 Bette Sirota Capital 311 25 0 0 0 00 Owner investment 1 Prepaid Rent 114 4 2 0 ...View the full answer

College Accounting A Practical Approach

ISBN: 9780134729312

14th Edition

Authors: Jeffrey Slater, Mike Deschamps

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

On September 1, 201X, Brittney Slater opened Brittney?s Art Studio. The following transactions occurred in September: Your tasks are to do the following: 1. Set up the ledger based on the following...

-

On June 1, 201X, Brenda Rennicke opened Brenda's Art Studio. The following transactions occurred in June: 201X June 1 Brenda Rennicke invested $52,000 in the art studio. 1 Paid 3 months' rent in...

-

On April 1, 201X, Beth Orth opened Beth's Art Studio. The following transactions occurred in April. 201X Apr. 1 Beth Orth invested $15,000 in the art studio. 1 Paid 2 months' rent in advance, $1,600....

-

Prepare budgetary and proprietary journal entries to record the following year- end adjustments: 1. An accrual of $ 60,000 was made for salaries earned the last week of September, to be paid in...

-

Koss Co. Ltd. began operations on January 1, 2015. It had the following transactions during 2015, 2016, and 2017. 2015 Dec. 31 Estimated uncollectible accounts as $5,000 (calculated as 2% of sales)...

-

Select from the following list the most appropriate form of finance for purchasing a new office building: a) ten-year mortgage loan b) a loan repayable in six months' time c) an arrangement with a...

-

At what point will the data be destroyed?

-

Acetone is to be extracted with n-hexane from a 40.0 wt% acetone60.0 wt% water mixtures at 25C The acetone distribution coefficient (mass fraction acetone in the hexane-rich phase/mass fraction...

-

Calculate the missing numbers that follow the list of account balances. Enter the digits only - no dollar signs or commas. Retained earnings at the beginning of the year is zero. Accounts receivable...

-

The following tables show the domestic supply and demand schedules for bushels of flaxseed (used as an edible oil and a nutrition supplement) in the United States and Kazakhstan, with prices measured...

-

Jarad Stone operates Jarad?s Cleaning Service. As the bookkeeper, you have been requested to journalize the following transactions: The chart of accounts for Jarad?s Cleaning Service is as follows:...

-

A 2.2-nF capacitor and one of unknown capacitance are in parallel across a 10-V rms sine-wave generator. At 1.0 kHz, the generator supplies a total current of 3.4 mA rms. The generator frequency is...

-

What are three disadvantages of the euro for Europe?

-

County has the Investment Activities recorded in its general fund: Tesla Stock: Cost $100, Fair Value on Jan 1x1: $200; Fair Value on Dec 31x2: $300 DJT Stock: Cost: $100; Fair Value on Jan 1x1:...

-

Pets World is a retailer of a popular blend of organic dog food produced by Natural Pets Company. On average, Pets World sells 600 cans per week. The wholesale price that Natural Pets Company charges...

-

Out Supply-Chaining the King of Supply Chainers, How easy (or hard) would it be for rivals like Walmart or Carrefour to adopt Tesco's data management techniques? (Please provide reference...

-

Compare the alternatives that Bergerac is considering for its decision. Include: Comparison of make versus buy option in the type of operation that Bergerac is looking to integrate. You do not need...

-

Let A, B, C and D be non-zero digits, such that CD is a two-digit positive integer. BCD is a three-digit positive integer generated by the digits B, C and D. ABCD is a four-digit positive integer...

-

Name the following rocks: (a) A fine-grained, unfoliated rock with intergrowing crystals of quartz, feldspar, and black mica; (b) A finely foliated rock with microscopic crystals of quartz and white...

-

You are maintaining a subsidiary ledger account for Police-Training Expenditures for 2013. The following columns are used: Inventory purchases are initially recorded as expenditures. Record the...

-

HipHop.com has requested that you prepare a partial balance sheet on December 31, 2021, from the following: Cash, $130,000; Petty Cash, $64; Accounts Receivable, $71,000; Bad Debts Expense, $50,000;...

-

Given the information presented in Figure 13.13, do the following: a. Prepare on December 31, 2021, the adjusting journal entry for Bad Debts Expense. Balances: Cash, $32,000; Accounts Receivable,...

-

Indicate next to each statement whether it refers to the income statement (IS), statement of owners equity (OE), or balance sheet (BS). a. b. C. d. Withdrawals found on it List total of all assets...

-

A farmer is concerned that the price of wheat will drop by the time he is ready to sell his crop. He, therefore, enters into a futures contract on 5,000 bushels of wheat for 250 cents per bushel. The...

-

On December 1, ABC Company received $3,000 cash from a customer for 3 months of business services beginning December 1st. Prepare the journal entry to record the receipt of the 3,000 and the...

-

When Kevin started working 23 years ago, his salary was $59,349. His current salary is $159,408. When Kevin started working, the price level was 134, while the current price level is 157. What was...

Study smarter with the SolutionInn App