On September 1 of this year, D. L. Porter established Porter P.0.1,2,3,4 Catering Service. The account headings

Question:

On September 1 of this year, D. L. Porter established Porter P.0.1,2,3,4 Catering Service. The account headings are presented on the next page. During September, Porter completed these transactions.

a. Invested cash in the business, $14,500.

b. Bought a truck for use in the business from Compton Motors for $12,490, paying $3,500 in cash, with the balance due in thirty days.

c. Bought catering equipment on account from Gallo Company, $2,236.

d. Paid rent for the month, $520.

e. Cash receipts for the first half of the month from cash customers, $1,920 (Income from Services).

f. Paid cash for property and liability insurance on truck for the year, $454.

g. Bought catering supplies for cash, $172.

h. Received and paid heating bill, $54 (Utilities Expense).

i. Received bill for gas and oil used for the truck during the current month from Clark Company, $93 (Gas and Oil Expense).

j. Billed customers for services performed on account, $416.

k. Receipts for the remainder of the month from cash customers, $2,412.

l. Paid salary of assistant, $1,240 (Salary Expense).

m. Porter withdrew cash for personal use, $1,950.

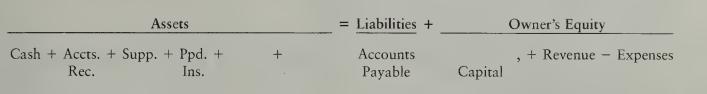

Instructions 1. In the equation, complete the asset section and list the owner’s name above the term Capital.

2. Record the transactions and the balance after each transaction. Identify the Check Figure account affected when the transaction involves revenue, expenses, or a Cash, $10,942 drawing.

3. Write the account totals from the left side of the equals sign and add them.

Write the account totals from the right side of the equals sign and add them.

If the two totals are not equal, first check the addition and subtraction. If you still cannot find the error, reanalyze each transaction.

Step by Step Answer:

College Accounting Chapters 1-26

ISBN: 9780395796993

6th Edition

Authors: Douglas J. McQuaig, Patricia A. Bille