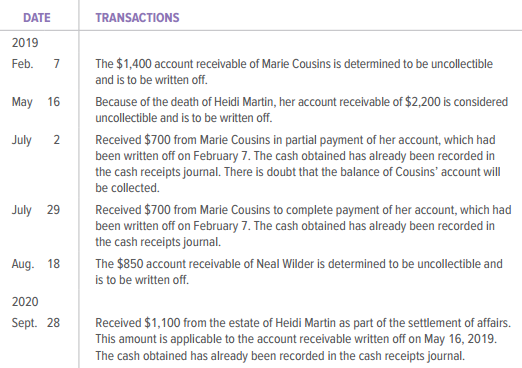

Pittman Company records uncollectible accounts expense as they occur. Selected transactions for 2019 and 2020 are described

Question:

Analyze: Based on these transactions, what net uncollectible accounts expense was recorded for the year 2019?

Transcribed Image Text:

TRANSACTIONS DATE 2019 The $1,400 account receivable of Marie Cousins is determined to be uncollectible and is to be written off. Feb. May 16 Because of the death of Heidi Martin, her account receivable of $2,200 is considered uncollectible and is to be written off. July Received $700 from Marie Cousins in partial payment of her account, which had been written off on February 7. The cash obtained has already been recorded in the cash receipts journal. There is doubt that the balance of Cousins' account will be collected. Received $700 from Marie Cousins to complete payment of her account, which had been written off on February 7. The cash obtained has already been recorded in the cash receipts journal. July 29 Aug. 18 The $850 account receivable of Neal Wilder is determined to be uncollectible and is to be written off. 2020 Sept. 28 Received $1,100 from the estate of Heidi Martin as part of the settlement of affairs. This amount is applicable to the account receivable written off on May 16, 2019. The cash obtained has already been recorded in the cash receipts journal. 2.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 77% (9 reviews)

GENERAL JOURNAL DATE DESCRIPTION POST REF DEBIT CREDIT 2019 Feb 7 Uncollectible Accounts Expense 1 4 ...View the full answer

Answered By

Susan Juma

I'm available and reachable 24/7. I have high experience in helping students with their assignments, proposals, and dissertations. Most importantly, I'm a professional accountant and I can handle all kinds of accounting and finance problems.

4.40+

15+ Reviews

45+ Question Solved

Related Book For

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina

Question Posted:

Students also viewed these Business questions

-

Pullman Company records uncollectible accounts expense as they occur. Selected transactions for 2016 and 2017 are described below. The accounts involved in these transactions are Notes Receivable,...

-

The Ideal Plumbing Company provides plumbing installation for both business and individual customers. The company records sales for the two types of customers in separate Sales accounts. The...

-

The Majestic Plumbing Company provides plumbing installations for both business and individual customers. The company records sales for the two types of customers in separate Sales accounts. The...

-

National paper Company must purchase a new machine for producing cardboard boxes. The company must choose between two machines. The machines produce boxes of equal quality, so the company will choose...

-

Advanced Technological Devices Inc. acquired a patent for $91,500. It spent an additional $31,250 successfully defending the patent in legal proceedings. Required: Determine the cost of the patent?

-

What is backflush accounting?

-

A card is randomly selected from a standard deck. Find the probability that the card is red or a queen.

-

The Handy-Dandy Department Store had forecast sales of $110,000 for the last week. The actual sales turned out to be $130,000. a. What is the forecast for this week, using exponential smoothing and ...

-

Suppose First Fidelity Bank engaged in the following transactions: (Click the icon to view the transactions.) Journalize the 2018 and 2019 transactions on First Fidelity's books. Explanations are not...

-

A negative feedback control system is depicted in Figure CP4.8. Suppose that our design objective is to find a controller Gc(s) of minimal complexity such that our closed-loop system can track a unit...

-

The balances of selected accounts of the Dexter Company on December 31, 2019, are given below: Accounts Receivable..........................................................................$ 425,000...

-

If a note dated February 28 has a three-month term, on what date must the note be paid?

-

Using the equations determine the equilibrium constant for the following reaction: HASO4 (aq) AsO4 (aq) + H+ (aq) K = 3.0 X 10-13 HASO4 (aq) + H+ (aq)HAsO4 (aq) K = 1.8 x 10

-

Watch Tre'Shawn's story (The QR code is in your text) https://www.youtube.com/watch?v=smIZLtDSPhU Using Chart 3.2 in your textbook describe what typical development for a 14-year-old boy would be...

-

Q17. An insurance company charges $500 for an insurance policy against fire and theft in the home. If a home is destroyed by fire, then the insurance company will pay the homeowner $250,000. What is...

-

If y = x ( 9 x + 5 ) , compute y ' .

-

1. Print out your name and section. 2. Create a java code to find speed of a car. a. Import the required codes to allow the user to enter data. b. The formula for speed is speed=distance/time. c. Ask...

-

Complete the square for 9 x 2 - 9 0 x + y 2 + 8 1 = 0

-

We have defined the degree of coherence 12 (a, ) for two points in the radiation field separated laterally by a distance a and longitudinally by a time . Under what conditions will this be given by...

-

How does health insurance risk differ from other types of insurance risk (e.g., automobile or homeowners insurance)? What is the difference between cost sharing and cost shifting? Is retiree health...

-

Jone Nelson and Helen Giddings are equal partners in N&G Appliance Center, which sells appliances and operates an appliance repair service. Nelson and Giddings have decided to incorporate the...

-

Denzel Corporation, a new corporation, took over the assets and liabilities of Delta Art on January 2, 2016. The assets and liabilities, after appropriate revaluation by Denzel, are as follows: Cash...

-

Jaguar Corporation was organized on March 1, 2016, to operate a delivery service. The firm is authorized to issue 75,000 shares of no-par-value common stock with a stated value of $100 per share and...

-

Famas Llamas has a weighted average cost of capital of 8.8 percent. The companys cost of equity is 12 percent, and its pretax cost of debt is 6.8 percent. The tax rate is 22 percent. What is the...

-

The common stock of a company paid 1.32 in dividens last year. Dividens are expected to gros at an 8 percent annual rate for an indefinite number of years. A) If the company's current market price is...

-

(1 point) Bill makes annual deposits of $1900 to an an IRA earning 5% compounded annually for 14 years. At the end of the 14 years Bil retires. a) What was the value of his IRA at the end of 14...

Study smarter with the SolutionInn App