Refer to Exercise 7A-3 and assume that the state changed Driving Companys SUTA tax rate to 4.6%.

Question:

Refer to Exercise 7A-3 and assume that the state changed Driving Company’s SUTA tax rate to 4.6%. What effect would this change have on the total payroll tax expense?

Exercise 7A-3:

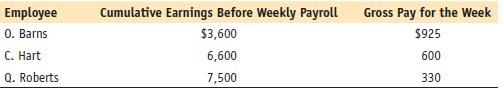

From the following information, calculate the payroll tax expense for Driving Company for the payroll of April 9:

The FICA tax rate for OASDI is 6.2% on the first $117,000 earned, and Medicare is 1.45% on all earnings. Federal unemployment tax is 0.6% on the first $7,000 earned by each employee. The SUTA tax rate for Driving Company is 5.8% on the first $7,000 of employee earnings for state unemployment purposes.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

College Accounting A Practical Approach Chapters 1-25

ISBN: 9780133791006

13th Edition

Authors: Jeffrey Slater

Question Posted: