Refer to Exercise 7B-3 and assume that the state changed News SUTA tax rate to 3.8%. What

Question:

Refer to Exercise 7B-3 and assume that the state changed New’s SUTA tax rate to 3.8%. What effect would this change have on the total payroll tax expense?

Exercise 7B-3:

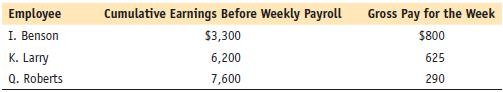

From the following information, calculate the payroll tax expense for New Company for the payroll of April 9:

The FICA tax rate for OASDI is 6.2% on the first $117,000 earned, and Medicare is 1.45% on all earnings. Federal unemployment tax is 0.6% on the first $7,000 earned by each employee. The SUTA tax rate for New is 5.9% on the first $7,000 of earnings for state unemployment purposes.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

College Accounting A Practical Approach Chapters 1-25

ISBN: 9780133791006

13th Edition

Authors: Jeffrey Slater

Question Posted: