The Babson Company pays its employees time-and-a-half for P.0.1,2,3,4 hours worked in excess of forty per week.

Question:

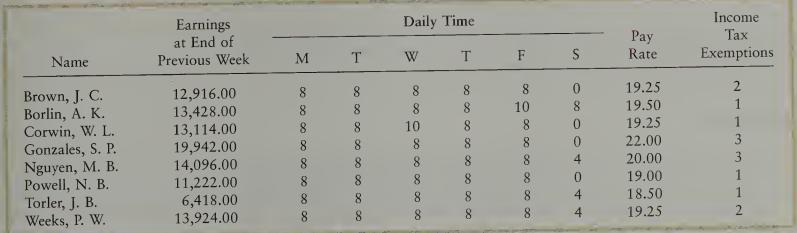

The Babson Company pays its employees time-and-a-half for P.0.1,2,3,4 hours worked in excess of forty per week. The information available from time cards and employees’ individual earnings records for the pay period ended Octo¬

ber 14 is as follows;

Taxable earnings for Social Security are based on the first $62,700. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000.

Instructions 1. Complete the payroll register, page 72, using the wage-bracket income tax withholding table in Figure 7-3 (page 256). The Social Security tax rate is 6.2 percent, and the Medicare tax rate is 1.45 percent. Assume that all employees are married.

2. Prepare a general journal entry to record the payroll. The firm’s general ledger contains a Wages Expense account and a Wages Payable account.

3. Assume that the firm transfers funds from its regular bank account to its spe¬

cial payroll bank account? Make the entry in the general journal.

4. Prepare a general journal entry to record the payment of wages. In the payroll register, begin payroll checks with number 942.

Step by Step Answer:

College Accounting Chapters 1-26

ISBN: 9780395796993

6th Edition

Authors: Douglas J. McQuaig, Patricia A. Bille