The following information for the Robledo Company is avail- P.O. 3,4 able from Robledos time books and

Question:

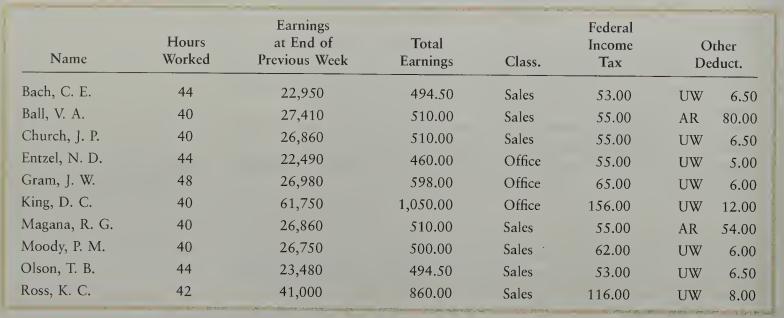

The following information for the Robledo Company is avail- P.O. 3,4 able from Robledo’s time books and the employees’ individual earnings records for the pay period ended December 22:

Taxable earnings for Social Security are based on the first $62,700. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state unemployment are based on the first $7,000.

Instructions 1. Complete the payroll register, page 56, using a Social Security tax rate of 6.2 percent and a Medicare tax rate of 1.45 percent. (The total of Social Security tax deduction and Medicare tax deduction for D. C. King is $74.13. Check this figure.) Concerning Other Deductions, AR refers to Accounts Receivable and UW refers to United Way. Begin payroll checks in the payroll register with number 971.

2. Prepare general journal entries to record the payroll, the transfer of cash to the cash-payroll bank account, and the payment to employees. Check Figure Net Amount, $4,619.67 Problem Set B

Step by Step Answer:

College Accounting Chapters 1-26

ISBN: 9780395796993

6th Edition

Authors: Douglas J. McQuaig, Patricia A. Bille