Using the data in situation b of Exercise 9-1, prepare the employers September 30 journal entries to

Question:

Using the data in situation b of Exercise 9-1, prepare the employer’s September 30 journal entries to record (1) salary expense and its related payroll liabilities for this employee and (2) payment of the pay- Payroll-related journal entries roll. BMX does not use a special payroll bank account.

Exercise 9-1:

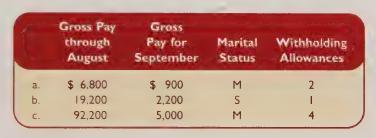

Computing payroll taxes and income tax withholdings

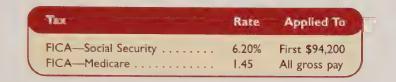

BMX Co. has one employee, Keesha Parks, and the company is subject to the following taxes:

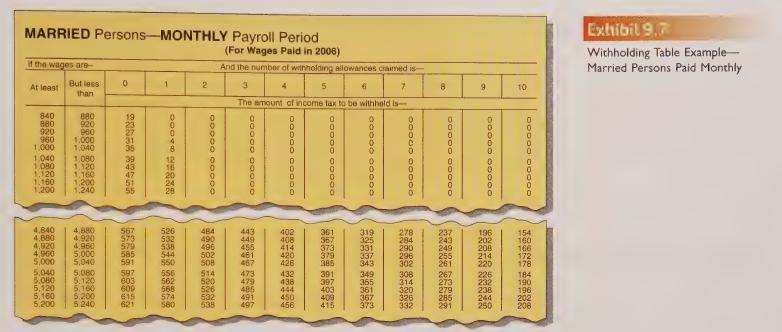

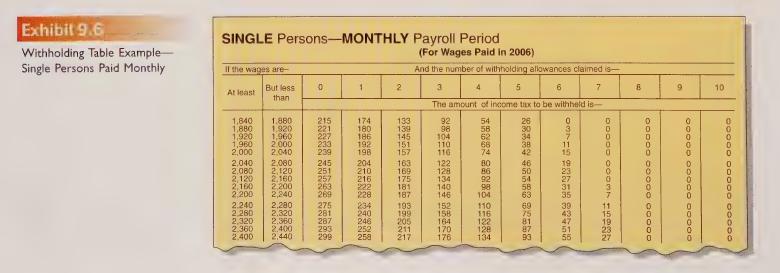

Compute BMX’s amounts for FICA taxes and federal income tax withholdings as applied to Keesha’s gross earnings for September under each of three separate situations (a), (b), and (c). (Use the withholding tables in Exhibit 9.6 and Exhibit 9.7.).

Step by Step Answer:

College Accounting Ch 1-14

ISBN: 9781260904314

1st Edition

Authors: John Wild, Vernon Richardson, Ken Shaw