Walters and Company, a retail carpet store, sells on the bases of (1) cash, (2) charge accounts,

Question:

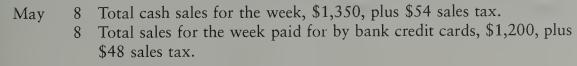

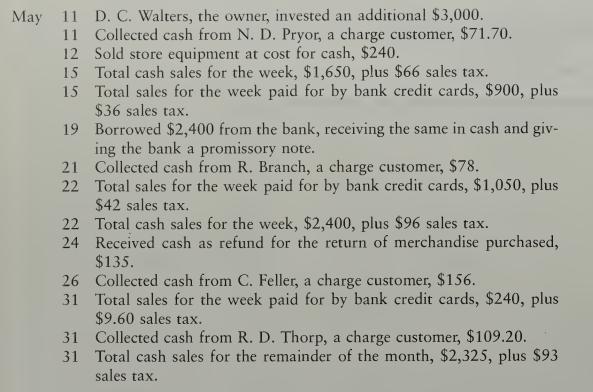

Walters and Company, a retail carpet store, sells on the bases of (1) cash, (2) charge accounts, and (3) bank credit cards. The following trans¬

actions involved cash receipts for the firm during May of this year. The state imposes a 4 percent sales tax on retail sales. The bank charges 4 percent on the total of the credit card sales plus sales tax. (For all sales involving credit cards, record credit card expense at the time of the sale.)

Instructions 1. Open the following accounts in the accounts receivable ledger and record the May 1 balances as given: R. Branch, $78; C. Feller, $186; S. R. Pratt, $114.72; N. D. Pryor, $71.70; R. D. Thorp, $176.47; F. N. Weeks, $79.52.

Place a check mark in the Post. Ref. column.

2. Record a balance of $706.41 in the Accounts Receivable controlling account as of May 1.

3. Record the transactions in the cash receipts journal beginning with page 62.

4. Post daily to the accounts receivable ledger.

5. Total and rule the cash receipts journal.

6. Prove the equality of debit and credit totals.

7. Post to the Accounts Receivable account in the general ledger.

Check Figure Total Sales Credit, $11,115

Step by Step Answer:

College Accounting Chapters 1-26

ISBN: 9780395796993

6th Edition

Authors: Douglas J. McQuaig, Patricia A. Bille