Budget Furniture, a home furnishings store, sells on the bases of (1) cash, (2) charge accounts, and

Question:

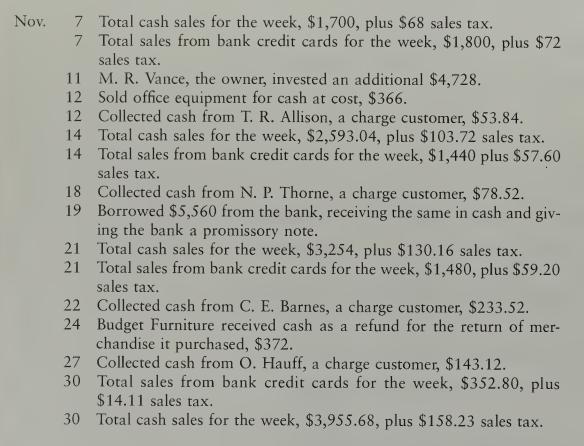

Budget Furniture, a home furnishings store, sells on the bases of (1) cash, (2) charge accounts, and (3) bank credit cards. The following trans¬

actions involve cash receipts for the firm for November of this year. The state imposes a 4 percent sales tax on retail sales. The bank charges 4 percent of the total credit card sales plus tax. (For all sales involving credit cards, record credit card expense at the time of the sale.)

Instrtictiofts Check Figure 1. Open the following accounts in the accounts receivable ledger and record the Credit, $16,575.52 November 1 balances as given: T. R. Allison, $193.84; C. E. Barnes, $233.52;

L. R. Cain, $106.46; L. P. Dunn, $179.52; O. Hauff, $143.12; N. P. Thorne, $78.52. Place a check mark in the Post. Ref. column.

2. Record a balance of $934.98 in the Accounts Receivable controlling account as of November 1.

3. Record the transactions in the cash receipts journal beginning with page 16.

4. Post daily to the accounts receivable ledger.

5. Total and rule the cash receipts journal.

6. Prove the equality of debit and credit totals.

7. Post to the Accounts Receivable account in the general ledger.

Step by Step Answer:

College Accounting Chapters 1-26

ISBN: 9780395796993

6th Edition

Authors: Douglas J. McQuaig, Patricia A. Bille