William Fuerst Company completes the following transactions during July of the current year. A tax rate of

Question:

William Fuerst Company completes the following transactions during July of the current year. A tax rate of 8% applies to all sales.

July

3 Sold \($6,000\) of merchandise on credit to Susan Scholz, Invoice No. 1060.

7 Sold \($4,500\) of merchandise on credit to Mike Ettredge, Invoice No. 1061.

9 Sold \($7,700\) of merchandise on credit to Mark Hirschey, Invoice No. 1062.

13. Sold \($1,600\) of merchandise on credit to Susan Scholz, Invoice No. 1063.

24 Sold \($5,300\) of merchandise on credit to Gilbert Karuga, Invoice No. 1064.

29 Sold \($7,100\) of merchandise on credit to Mark Hirschey, Invoice No. 1065.

Required

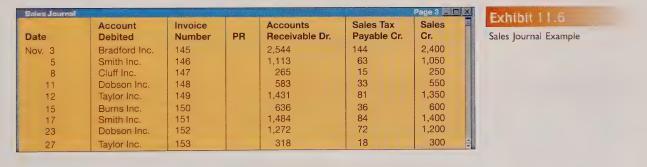

Divide your team into two groups. Have one group prepare the general journal entries for each sale. Have the other group prepare a sales journal like that in Exhibit 11.6. Compare and contrast the advantages and disadvantages of each approach.

Step by Step Answer:

College Accounting Ch 1-14

ISBN: 9781260904314

1st Edition

Authors: John Wild, Vernon Richardson, Ken Shaw