Doner Company Inc. established a foreign subsidiary on January 1, Year 1. The subsidiarys financial statements in

Question:

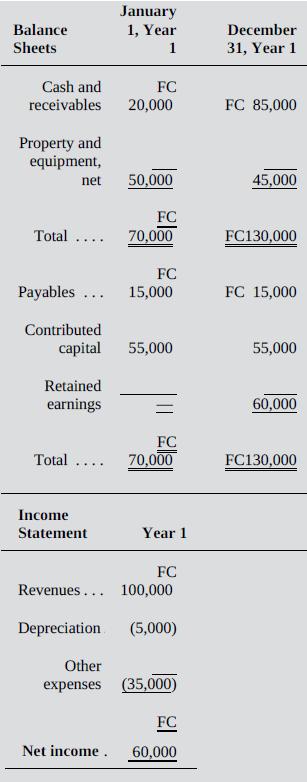

Doner Company Inc. established a foreign subsidiary on January 1, Year 1. The subsidiary’s financial statements in foreign currency (FC) for the year ended December 31, Year 1, appear as follows:

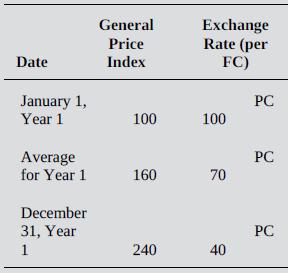

Revenues and expenses occur evenly throughout the year. Revenues and other expenses are realized in cash during the year. General price indexes (GPI) and parent currency (PC) per FC exchange rates for Year 1 are as follows:

Required:

a. Translate the foreign subsidiary’s Year 1 foreign currency (FC) financial statements into parent currency (PC) using IFRS.

b. Remeasure the foreign subsidiary’s Year 1 foreign currency (FC) financial statements into parent currency (PC) using U.S. GAAP.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

International Accounting

ISBN: 978-1260466539

5th edition

Authors: Timothy Doupnik, Mark Finn, Giorgio Gotti, Hector Perera