Imogdi Corporation (a U.S-based company) has a wholly-owned subsidiary in Argentina, whose manager is being evaluated on

Question:

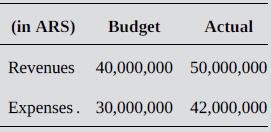

Imogdi Corporation (a U.S-based company) has a wholly-owned subsidiary in Argentina, whose manager is being evaluated on the basis of the variance between actual profit and budgeted profit in U.S. dollars. Relevant information in Argentine pesos (ARS) for the current year is as follows:

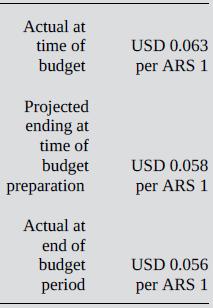

Current year actual and projected exchange rates between the ARS and the U.S. dollar (USD) are as follows:

Required:

a. Calculate the total budget variance for the current year using each of the five combinations of exchange rates for translating budgeted and actual results shown in Exhibit 10.10.

b. Make a recommendation to Imogdi’s corporate management as to which combination in item (a) should be used, assuming that the manager of the Argentinian subsidiary does not have the authority to hedge against changes in exchange rates.

c. Make a recommendation to Imogdi’s corporate management as to which combination in item (a) should be used, assuming that the manager of the Argentinian subsidiary has the authority to hedge against unexpected changes in exchange rates.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

International Accounting

ISBN: 978-1260466539

5th edition

Authors: Timothy Doupnik, Mark Finn, Giorgio Gotti, Hector Perera