Question:

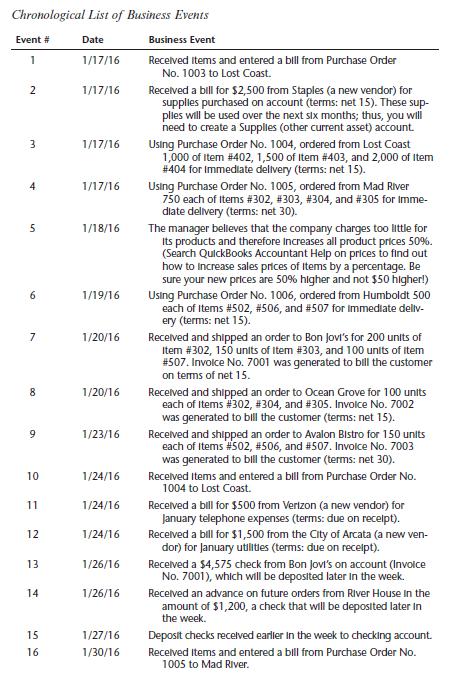

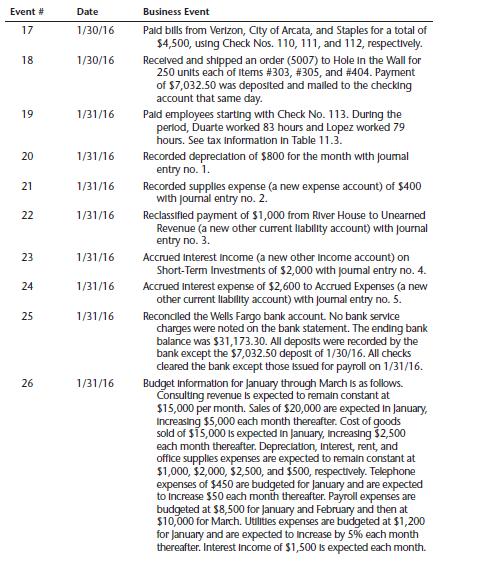

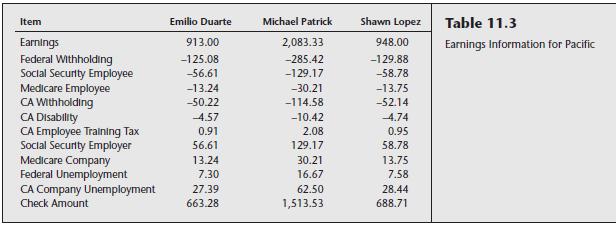

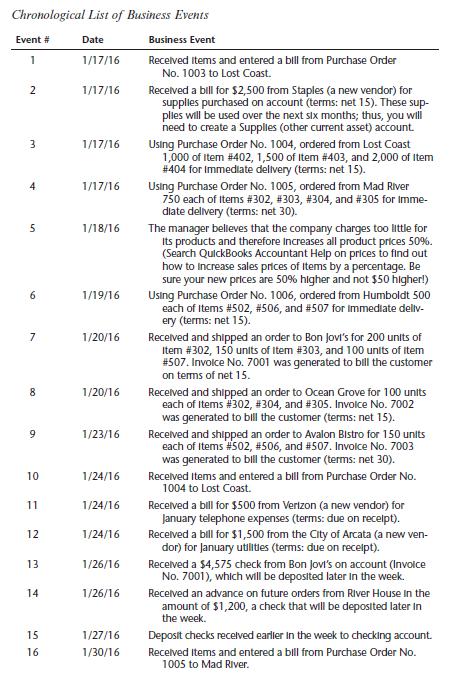

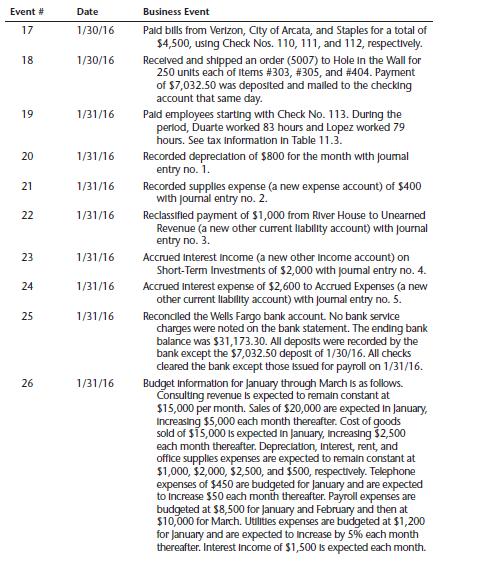

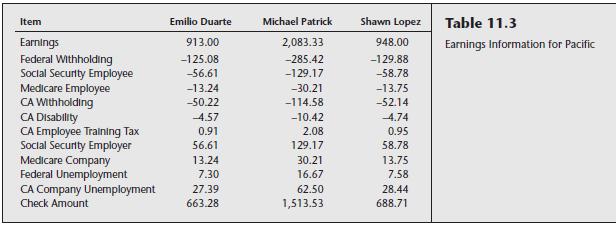

Make a copy of the QuickBooks Accountant file you created for Pacific Brew in that chapter. Record the following business events in chronological order (remember, dates are in the month of January 2016).

Create, memorize, and print the following reports with no date prepared, time prepared, or report basis fields. When memorizing, you can choose to replace the existing report if one existed or add the chapter number to the title.

a. Transaction List by Date for January 2016 in landscape orientation.

b. Profit & Loss Statement for January 2016 with a % of Income column using a right layout and without cents. Sort by total, largest to smallest.

c. Balance Sheet as of 1/31/16 with a % of Column with a right layout and without cents.

d. Statement of Cash Flows for January 2016 with a right layout and without cents.

e. Profit & Loss Budget vs. Actual for January 2016, without cents, sorted by total (largest to smallest).

f. Profit & Loss Budget Overview for January 2016 through March 2016, without cents, sorted by total (largest to smallest).

g. Sales by Customer Summary Report for the month ended 1/31/16, sorted by total (from largest to smallest amount) with month columns.

h. Sales by Item Summary Report for the month ended 1/31/16, without cents, sorted by total (from largest to smallest amount) with total only columns and in landscape orientation.

i. Income and Expense by Account graph for the month of January 2016.

j. Inventory Stock Status by Item report for January 2016.

k. Export the Profit & Loss Statement created in (b) to Excel, and then print the Excel worksheet with gridlines and row and column headers.

l. Reconciliation Summary as of 1/31/16.

Transcribed Image Text:

Chronological List of Business Events Event # Date 1 1/17/16 2 1/17/16 3 1/17/16 4 1/17/16 5 1/18/16 6 1/19/16 7 1/20/16 8 1/20/16 9 1/23/16 10 1/24/16 11 1/24/16 12 1/24/16 13 1/26/16 14 1/26/16 15 1/27/16 16 1/30/16 Business Event Received Items and entered a bill from Purchase Order No. 1003 to Lost Coast. Received a bill for $2,500 from Staples (a new vendor) for supplies purchased on account (terms: net 15). These sup- plies will be used over the next six months; thus, you will need to create a Supplies (other current asset) account. Using Purchase Order No. 1004, ordered from Lost Coast 1,000 of Item #402, 1,500 of Item # 403, and 2,000 of Item #404 for Immediate delivery (terms: net 15). Using Purchase Order No. 1005, ordered from Mad River 750 each of Items #302, #303, #304, and # 305 for Imme- diate delivery (terms: net 30). The manager believes that the company charges too little for Its products and therefore Increases all product prices 50%. (Search QuickBooks Accountant Help on prices to find out how to increase sales prices of items by a percentage. Be sure your new prices are 50% higher and not $50 higher!) Using Purchase Order No. 1006, ordered from Humboldt 500 each of Items #502, # 506, and #507 for Immediate deliv- ery (terms: net 15). Received and shipped an order to Bon Jovi's for 200 units of Item #302, 150 units of Item # 303, and 100 units of item #507. Invoice No. 7001 was generated to bill the customer on terms of net 15. Received and shipped an order to Ocean Grove for 100 units each of Items #302, #304, and #305. Invoice No. 7002 was generated to bill the customer (terms: net 15). Received and shipped an order to Avalon Bistro for 150 units each of Items #502, # 506, and #507. Invoice No. 7003 was generated to bill the customer (terms: net 30). Received Items and entered a bill from Purchase Order No. 1004 to Lost Coast. Received a bill for $500 from Verizon (a new vendor) for January telephone expenses (terms: due on receipt). Received a bill for $1,500 from the City of Arcata (a new ven- dor) for January utilities (terms: due on receipt). Received a $4,575 check from Bon Jovi's on account (Invoice No. 7001), which will be deposited later in the week. Received an advance on future orders from River House in the amount of $1,200, a check that will be deposited later in the week. Deposit checks received earlier in the week to checking account. Received Items and entered a bill from Purchase Order No. 1005 to Mad River.