Allison and Paul are married and have no children. Paul is a lawyer who earns a salary

Question:

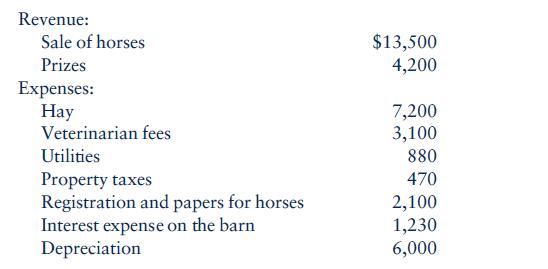

Allison and Paul are married and have no children. Paul is a lawyer who earns a salary of $80,000. In November 2009, Allison quit her job as a copy editor and began exploring the possibility of breeding and showing horses. She would run the business on their property. Allison expects to travel to nine or ten horse shows during the year. While researching the activity, she came across an article entitled: ‘‘IRS Cracking Down on Horse Breeding—Is It Really a Business or Is It a Hobby?’’ She is unsure of the tax ramifications discussed in the article and has come to you for advice on whether her activity will be considered a business or a hobby. Allison provides you with the following projections of the 2010 income and expense items for the horse breeding and showing activity:

Paul and Allison expect to receive $6,000 in interest and dividend income, they will have an $8,000 net long-term capital gain, and their other itemized deductions will total $16,300 in 2010. Write a letter to Allison explaining the factors the IRS will use to determine whether she is engaged in a trade or business or a hobby. You should also provide her with a calculation of their taxable income and tax liability and explain the difference(s) caused by the classification of the horse breeding and showing activity as a business or as a hobby.

Step by Step Answer:

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins