Conrad purchases a condominium in Aspen, Colorado. Because of his hectic work schedule, Conrad is unsure how

Question:

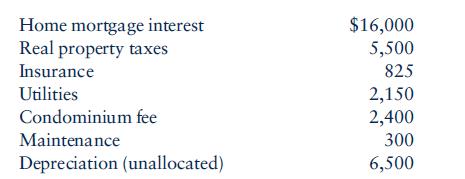

Conrad purchases a condominium in Aspen, Colorado. Because of his hectic work schedule, Conrad is unsure how much he will be able to use the condo over the next few years. A friend of his who has a condo in Aspen tells him that the condominium is both a great investment and an excellent tax shelter. Conrad’s friend has been able to rent his condominium for $1,000 per week. Conrad expects to incur the following expenses related to the condominium:

Conrad is somewhat hesitant to rent his new condo out for the entire year, just in case he can sneak away from work for a few days. Therefore, he wants to explore all his options. Explain the different tax treatments of his condominium expenses depending on the number of days he uses it.

Step by Step Answer:

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins