Mark Pari is a self-employed electrician who exclusively uses a room in his home to Tax Form

Question:

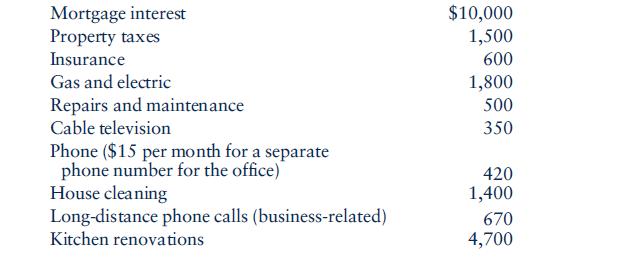

Mark Pari is a self-employed electrician who exclusively uses a room in his home to Tax Form perform the administrative functions related to his business. The room is 250 square feet of the 2,500 total square feet of his home. Mark’s income from his business before considering the cost of his home office is $62,890. He incurs the following expenses related to his home:

Assume that the home is worth $200,000. Mark’s basis is 140,000, the value of the land is 20% of basis, and the applicable depreciation percentage is 2.564%. Complete form 8829 using the above information. Mark’s Social Security number is 136-42-

5677. Forms and instructions can be downloaded from the IRS Web site (www.irs .gov/formspubs/index.html).

Step by Step Answer:

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins