Assume that the building in problem 68 is an apartment building held for investment. In addition to

Question:

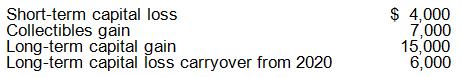

Assume that the building in problem 68 is an apartment building held for investment. In addition to the sale of the building, Anton has the following capital gains and losses during 2021:

Anton is single and has a taxable income of $175,000 without considering his capital gains and losses. What is his taxable income and income tax liability?

Transcribed Image Text:

Short-term capital loss Collectibles gain Long-term capital gain Long-term capital loss carryover from 2020 $ 4,000 7,000 15,000 6,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

The collectibles gain and the unrecaptured Section 1250 gain are longterm capital gains in the capital gain ...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Concepts In Federal Taxation 2022

ISBN: 9780357515785

29th Edition

Authors: Kevin E. Murphy, Mark Higgins, Tonya K. Flesher

Question Posted:

Students also viewed these Business questions

-

Assume that the building in problem 68 is an apartment building held for investment. In addition to the sale of the building, Anton has the following capital gains and losses during 2016: Short-term...

-

Assume that the building in problem 68 is an apartment building held for investment. In addition to the sale of the building, Anton has the following capital gains and losses during 2020: Short-term...

-

Assume that the building in problem 68 is an apartment building held for investment. In addition to the sale of the building, Anton has the following capital gains and losses during 2011: Short-term...

-

Dickletton Attorneys' policy is to bank all receipts in its Trust bank account and at the end of each month the bookkeeper transfers the relevant funds due to Dickletton Attorneys from the trust to...

-

There is an important link between decision-making and managerial performance evaluation. Explain.

-

Then have the students in your class complete the scorecard now and again in the middle of the semester.

-

Describe how a stability strategy is implemented. LO1

-

In Problem 9, the first-order interactions between Z and the predictor variables X1, X3, and X4 were not included in the model selection process. Investigate whether this was appropriate, as follows...

-

Ilene owns an unincorporated manufacturing business. In 2019, she purchases and places in service $2,650,000 of qualifying five-year equipment for use in her business. Her taxable income from the...

-

Martha Millon, financial manager for Fish & Chips Inc., has been asked to perform a lease-versus-buy analysis on a new computer system. The computer system has an after-tax cost of $975,000, and if...

-

Rhinelander Corporation has the following net Section 1231 gains and losses for 2016 through 2020: a. What is the proper characterization of the net Section 1231 gains and losses for 2016 - 2020 for...

-

The Gladys Corporation buys equipment (7-year MACRS property) costing $1,114,000(Typo-Should be $1,124,000 to match the amount in problem 48 of chapter 10) on May 12, 2021. In 2024, new and improved...

-

After successfully completing your corporate finance class, you feel the next challenge ahead is to serve on the board of directors of Schenkel Enterprises. Unfortunately, you will be the only...

-

Write a program that solves either a) the Towers of Hanoi problem with up to 1000 disks, or, b) the Traveling Salesman problem with up to 10 cities. You may need to wait until you have read about...

-

Consider the E-R diagram in Figure 8-15b. a. What would be the identifier for the CERTIFICATE associative entity if Certificate Number were not included? b. Now assume that the same employee may take...

-

z = 1.1 for H a : < 149.6 Find the P-value that corresponds to the standard z-score, and determine whether the alternative hypothesis is supported at the 0.05 significance level.

-

An object is placed \(150 \mathrm{~mm}\) away from a converging thin lens that has a focal length of \(400 \mathrm{~mm}\). What are (a) the image distance and \((b)\) the magnification? (c) Draw a...

-

Let $M$ be the four-dimensional Minkowski space, with coordinates $x^{0}, x^{1}, x^{2}$, and $x^{3}$. Let us define a linear operator $*: \Omega^{r}(M) ightarrow$ $\Omega^{4-r}(M)$, such that...

-

Since 1995, Starbucks Corporation had owned a 39.5 percent equity interest in Starbucks Coffee Japan, Ltd. ("Starbucks Japan"). Its joint venture partner, Sazaby League of Japan also owned a 39.5...

-

Why do bars offer free peanuts?

-

Discuss whether the following expenditures meet the ordinary, necessary, and reasonable requirements: a. The Brisbane Corporation is being sued in connection with allegations that it produced a...

-

For each of the following situations, discuss whether the expense is currently deductible or must be capitalized: a. The Mickleham Hotel installs a $125,000 sprinkler system to comply with recently...

-

Rebecca is the head chef at a local restaurant and is exploring the possibility of leaving her current job and opening her own restaurant in a nearby town. She has spent $15,000 investigating...

-

1,600 Balance Sheet The following is a list (in random order) of KIP International Products Company's December 31, 2019, balance sheet accounts: Additional Paid-In Capital on Preferred Stock $2,000...

-

Question 3 4 pts 9 x + 3 x 9 if x 0 Find a) lim f(x), b) lim, f(x), C), lim , f(x) if they exist. 3 Edit View Insert Format Tools Table : 12pt M Paragraph B IV A2 Tv

-

Mr. Geoffrey Guo had a variety of transactions during the 2019 year. Determine the total taxable capital gains included in Mr. Guo's division B income. The transactions included: 1. On January 1,...

Study smarter with the SolutionInn App