Astrid, who is single, is a sales representative for several sporting goods manufacturers. She operates her enterprise

Question:

Astrid, who is single, is a sales representative for several sporting goods manufacturers.

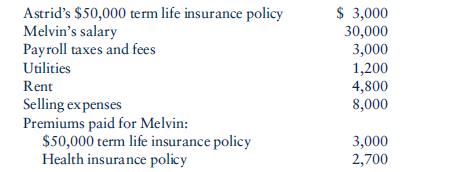

She operates her enterprise as a sole proprietorship. Astrid has one employee, Melvin, who serves as office manager for the business. Gross revenues are $250,000 annually. Annual operating expenses are

Astrid takes an annual draw of $2,700 to pay for health insurance coverage equal to Melvin’s. Assume Astrid is paid a salary of $100,000 and has income from other sources that offset her allowable deductions. Astrid is considering incorporating her business.

Discuss the benefits that will accrue to Astrid by incorporating. Recommend any alternative courses of action. [HINT: Don’t forget Social Security/self-employment tax.]

Step by Step Answer:

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins