Question

Complete a Balance Sheet and Statement of Cash Flow Acquired cash of $225,000 from the issue of common stock. Borrowed $175,000

Complete a Balance Sheet and Statement of Cash Flow

Acquired cash of $225,000 from the issue of common stock.

Borrowed $175,000 cash from the bank on April 1, 2018.

Paid $285,000 cash to purchase fixed assets - land that cost $65,000

and a building that cost $220,000.

Earned and recognized consulting revenue on account for $345,000

Collected $200,000 on the accounts receivable during the year

Incurred $150,000 of consulting expenses on account during the year.

Paid $125,000 on the accounts payable during the year.

Paid $92,500 cash for other operating expenses during the year.

Paid the company owners $5,300 of dividends.

Received $21,750 cash for services to be performed in the future.

On June 1, paid $10,500 cash in advance for a one-year lease to rent office space.

Paid $9,450 cash for salaries expense.

Information for December 31, 2018

ADJUSTING ENTRIES:

Completed $11,350 of services performed described in Transaction 10.

Adjust Prepaid Rent account for rent used up during the year. (7

months)

Use the straight-line method to depreciate the building purchased in

Transaction 3. Management estimated that it had a useful life of 20

years. Record the building depreciation.

Recognized that $3,647 of Salary Expense has been incurred on

December 31. The employees are owed this for the services they provided in December but will not be paid to them until January. Record the year end accrual for salary expense.

Accrued interest expense for loan in # 2. Terms: interest rate 10%, in one year. (Loan was outstanding 9 months during 2018).

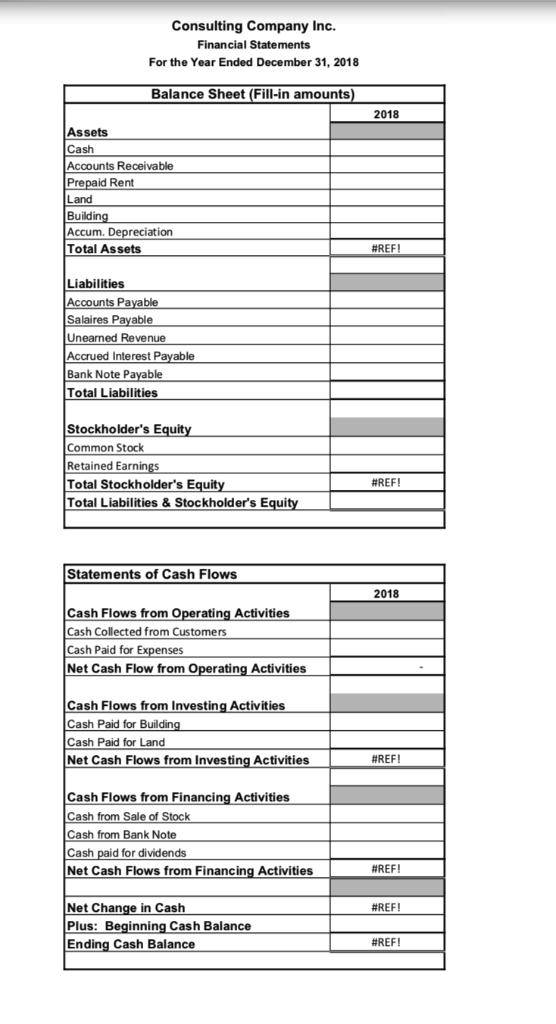

Consulting Company Inc. Financial Statements For the Year Ended December 31, 2018 Balance Sheet (Fill-in amounts) Assets Cash Accounts Receivable Prepaid Rent Land Building Accum. Depreciation Total Assets Liabilities Accounts Payable Salaires Payable Unearned Revenue Accrued Interest Payable Bank Note Payable Total Liabilities Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities & Stockholder's Equity Statements of Cash Flows Cash Flows from Operating Activities Cash Collected from Customers Cash Paid for Expenses Net Cash Flow from Operating Activities Cash Flows from Investing Activities Cash Paid for Building Cash Paid for Land Net Cash Flows from Investing Activities Cash Flows from Financing Activities Cash from Sale of Stock Cash from Bank Note Cash paid for dividends Net Cash Flows from Financing Activities Net Change in Cash Plus: Beginning Cash Balance Ending Cash Balance 2018 #REF! #REF! 2018 #REF! #REF! #REF! #REF!

Step by Step Solution

3.53 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Consulting Company Inc Balance Sheet December 31 2018 Assets Cash and Cash Equivalents Calculate the cash balance based on the provided information Ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started