Answered step by step

Verified Expert Solution

Question

1 Approved Answer

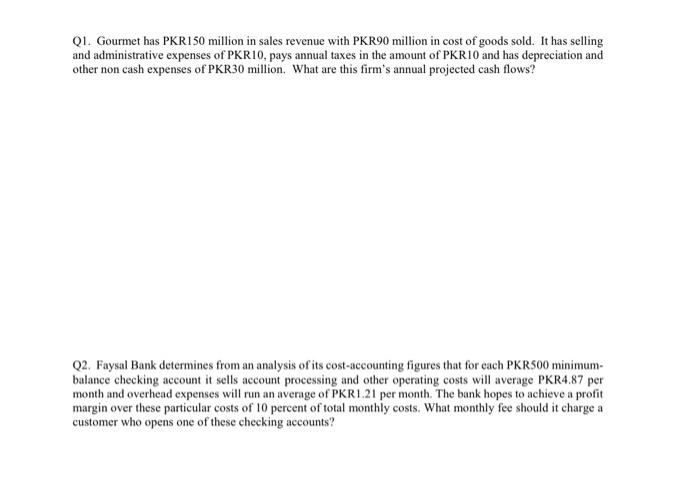

Q1. Gourmet has PKR150 million in sales revenue with PKR90 million in cost of goods sold. It has selling and administrative expenses of PKR10,

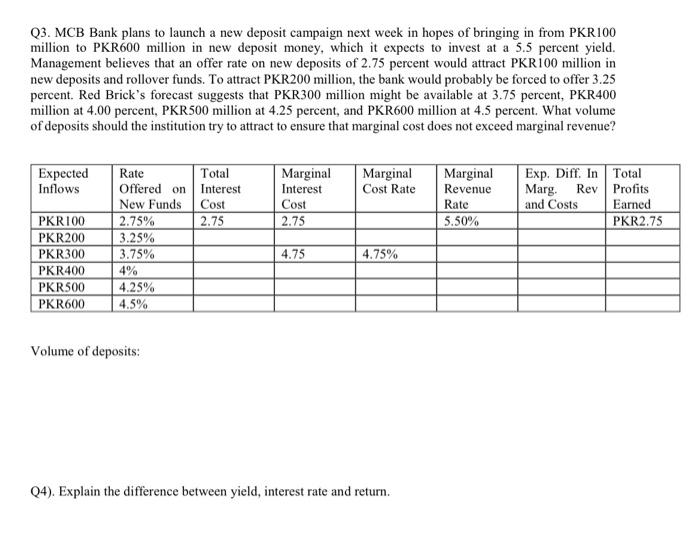

Q1. Gourmet has PKR150 million in sales revenue with PKR90 million in cost of goods sold. It has selling and administrative expenses of PKR10, pays annual taxes in the amount of PKR10 and has depreciation and other non cash expenses of PKR30 million. What are this firm's annual projected cash flows? Q2. Faysal Bank determines from an analysis of its cost-accounting figures that for each PKR500 minimum- balance checking account it sells account processing and other operating costs will average PKR4.87 per month and overhead expenses will run an average of PKR1.21 per month. The bank hopes to achieve a profit margin over these particular costs of 10 percent of total monthly costs. What monthly fee should it charge a customer who opens one of these checking accounts? Q3. MCB Bank plans to launch a new deposit campaign next week in hopes of bringing in from PKR100 million to PKR600 million in new deposit money, which it expects to invest at a 5.5 percent yield. Management believes that an offer rate on new deposits of 2.75 percent would attract PKR100 million in new deposits and rollover funds. To attract PKR200 million, the bank would probably be forced to offer 3.25 percent. Red Brick's forecast suggests that PKR300 million might be available at 3.75 percent, PKR400 million at 4.00 percent, PKR500 million at 4.25 percent, and PKR600 million at 4.5 percent. What volume of deposits should the institution try to attract to ensure that marginal cost does not exceed marginal revenue? Expected Inflows Rate Offered on New Funds Total Interest Marginal Interest Marginal Cost Rate Marginal Revenue Cost Cost PKR100 2.75% 2.75 2.75 Rate 5.50% Exp. Diff. In Marg. Rev and Costs Total Profits Earned PKR2.75 PKR200 3.25% PKR300 3.75% 4.75 4.75% PKR400 4% PKR500 4.25% PKR600 4.5% Volume of deposits: Q4). Explain the difference between yield, interest rate and return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Q1 Gourmets Annual Projected Cash Flows To calculate the projected cash flows we use the following formula Cash Flow Net Income NonCash Expenses eg Depreciation Here are the details provided Sales Rev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started