Calvin and Lorna live in Nebraska and own rental property in the Ozark Mountains. They have always

Question:

Calvin and Lorna live in Nebraska and own rental property in the Ozark Mountains.

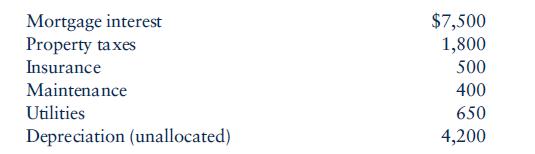

They have always prepared their own tax return and have allocated their rental expenses including their mortgage interest and property taxes using the ratio of personal days to total days of use. During the year, they rent the property for 75 days and use it for 25 days. They receive $8,500 in rental income and incur the following expenses:

One of Calvin’s neighbors tells him that there is a better way to deduct the mortgage interest and property taxes on the rental that results in a greater tax deduction. Find authority for a different method for deducting mortgage interest and property taxes on Calvin and Lorna’s rental property, and calculate the effect of that method on their taxable income.

Step by Step Answer:

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins