Fred's Foam Foundations (FFF) is a sole proprietorship that Fred started in 2016. Before the current year,

Question:

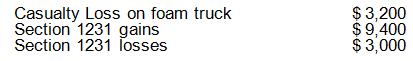

Fred's Foam Foundations (FFF) is a sole proprietorship that Fred started in 2016. Before the current year, FFF had not disposed of any property it owned. During the current year, FFF has the following gains and losses:

What is the effect of these transactions on Fred's taxable income? Explain, and show the calculations.

Transcribed Image Text:

Casualty Loss on foam truck Section 1231 gains Section 1231 losses $3,200 $ 9,400 $ 3,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

The Section 1231 netting results in an ordinary loss of 3200 and a net longte...View the full answer

Answered By

Vineet Kumar Yadav

I am a biotech engineer and cleared jee exam 2 times and also i am a math tutor. topper comunity , chegg India, vedantu doubt expert( solving doubt for iit jee student on the online doubt solving app in live chat with student)

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Concepts In Federal Taxation 2022

ISBN: 9780357515785

29th Edition

Authors: Kevin E. Murphy, Mark Higgins, Tonya K. Flesher

Question Posted:

Students also viewed these Business questions

-

Freds Foam Foundations (FFF) is a sole proprietorship that Fred started in 2006. Before the current year, FFF had not disposed of any property it owned. During the current year, FFF has the following...

-

Fred's Foam Foundations (FFF) is a sole proprietorship that Fred started in 2011. Before the current year, FFF had not disposed of any property it owned. During the current year, FFF has the...

-

Fred's Foam Foundations (FFF) is a sole proprietorship that Fred started in 2012. Before the current year, FFF had not disposed of any property it owned. During the current year, FFF has the...

-

What are the roles and responsibilities of civil society in relation to the Sustainable Development Goals? In your country, how has civil society been engaged in the dialogue or discussion on...

-

What is a joint production process? Describe a special decision that commonly arises in the context of a joint production process. Briefly describe the proper approach for making this type of...

-

Match the industry type to the expected benefits from an MRP system as High, Medium, or Low. Industry Type Expected Benefit (High, Medium, or Low) Assemble-tostock Assemble-toorder Make-to-stock...

-

Describe the two organizational renewal strategies. LO1

-

The Spring family has owned and operated a garden tool and implements manufacturing company since 1952. The company sells garden tools to distributors and also directly to hardware stores and home...

-

Please no handwritten answers. Are there any red flags in financial statement analysis? Can technology be used to prevent fraud? Explain.

-

Alice J. and Bruce M. Byrd are married taxpayers who file a joint return. Their Social Security numbers are 123-45-6789 and 111-11-1111, respectively. Alice's birthday is September 21, 1966, and...

-

Dawn started her own rock band on January 2, 2019. She acquired all her equipment on January 2, 2019, and did not dispose of any of it before 2021. On April 15, 2021, the bands amplifier, speakers,...

-

Ansel sells 400 shares of Sharpe, Inc., common stock on October 12, 2021 for $11,800 and pays $600 in commissions on the sale. He acquired the stock for $18,400 plus $800 in commissions on July 8,...

-

What essential feature distinguishes the contribution margin income statement from the traditional income statement? ku69

-

The amounts of caffeine in a sample of five-ounce servings of brewed coffee are shown in the histogram. Number of 5-ounce servings S 25- 20 15 10 25 12 10 1 2 70.5 92.5 114.5 136.5 158.5 Caffeine (in...

-

Tom, David, Dale, and Murdock are four business students who want to rent a four- bedroom apartment together for the fall semester. They have identified the three factors important to them in...

-

Listed below, out of order, are the steps in an accounting cycle. 1. Prepare the unadjusted trial balance. 2. Post journal entries to general ledger accounts. 3. Analyze transactions from source...

-

Consider Quick Start QFD Matrix 2 above. Which two technical specifications are strongly correlated with each other? Quick Start QFD Matrix 2 Strong positive correlation Some positive correlation ==...

-

A cylindrical solenoid of length \(\ell\) and radius \(R\) has \(n\) windings per unit length and carries a current \(I\). (a) Use the inductance expression \(L=\left(\mu_{0} N^{2} A ight) / \ell\)...

-

Amie, Inc., has 100,000 shares of $2 par value stock outstanding. Prairie Corporation acquired 30,000 of Amie's shares on January 1, 2015, for $120,000 when Amie's net assets had a total fair value...

-

Suppose the spot and six-month forward rates on the Norwegian krone are Kr 5.78 and Kr 5.86, respectively. The annual risk-free rate in the United States is 3.8 percent, and the annual risk-free rate...

-

Estel and Raymond own the GoalLine Partnership. Estel owns 70% of the busi- Communication Skills ness. She provided the capital for it and consults with Raymond on overall business strategy. Raymond...

-

Artis owns 40%of the Rhode Island Chile Parlor (RICP). During the current year, Rhode Island gives Artis fringe benefits worth $4,000 in addition to his $30,000 salary. RICP's net taxable income...

-

Enterprise Business Systems pays the $5,000 health and accident insurance policy of its owner, Gena. The business's net operating income for the year is $60,000 before considering Gena's benefit....

-

Assignment Title: The Role of Bookkeeping in Business Management and Financial Reporting Objective: Understand the importance of proper bookkeeping procedures in the management of...

-

17) The adjustment that is made to allocate the cost of a building over its expected life is called:A) depreciation expense.B) residual value.C) accumulated depreciation.D) None of the above answers...

-

9) Prepaid Rent is considered to be a(n):A) liability.B) asset.C) contra-asset.D) expense.10) As Prepaid Rent is used, it becomes a(n):A) liability.B) expense. C) contra-asset.D) contra-revenue.11)...

Study smarter with the SolutionInn App