Joe and Sharon Racca are married and have two children. Joe works as a sales man- Tax

Question:

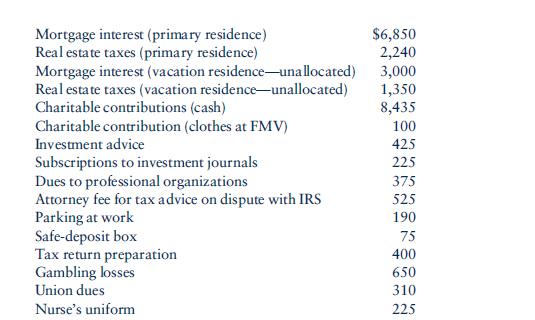

Joe and Sharon Racca are married and have two children. Joe works as a sales man- Tax Form ager for a national pharmaceutical company and Sharon is a nurse. They own a vacation home in New Hampshire that is used 30% for personal purposes. During the year they receive $1,600 in reimbursements from their medical plan and report

$2,200 of investment income. They contributed stock with a fair market value of

$4,000 that they acquired in 2000 at a cost of $1,700 to Stanton College. The Raccas’

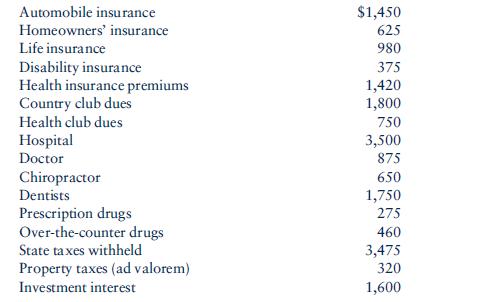

gambling winnings for the year were $1,000 and are included in their adjusted gross income. Their adjusted gross income for the year is $88,000 and they provide you with the following data:

Unreimbursed employee business expenses (after allocation but before limitations)

Complete Form 1040 Schedule A. Joe’s Social Security number is 063-79-4105 and Sharon’s Social Security number is 530-22-6584. Forms and instructions can be downloaded from the IRS Web site (www.irs.gov/formspubs/index.html).

Step by Step Answer:

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins