Robert and Susan (both 39) are married and have 2 children. Their son, Dylan, is 8 and

Question:

Robert and Susan (both 39) are married and have 2 children. Their son, Dylan, is 8 and their daughter, Harper, is 3.

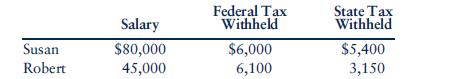

Susan sells pharmaceuticals for the Bendigo Drug Company. Robert is a teacher at the local junior high school. In the summer, Robert earns extra money as a self-employed house painter. Their income from their jobs is as follows:

Bendigo has a cafeteria benefits plan that lets employees select benefits equal to as much as 10% of their annual salary or receive the cash equivalent. Susan selects dental insurance, $160,000 in group term life insurance, disability insurance, and company-provided day care. The total cost to Bendigo of these benefits is $6,600.

Susan takes the remaining benefits to which she is entitled in cash. Because Bendigo does not have an employee pension plan, Robert and Susan each contribute $5,000 to their individual retirement accounts.

The school district gives Robert medical insurance and group term life insurance equal to 100% of his annual salary. He pays an additional $125 a month to cover Susan and the children under his medical plan. The school district also has a qualified contributory pension plan to which it contributes 5% of Robert’s annual salary;

he is required to contribute 3%. Robert is allowed to make additional contributions of up to 2% of his salary, and he contributes the maximum.

In addition to the life insurance coverage provided by their employers, Robert and Susan purchase $100,000 in whole life insurance on each other, along with a disability insurance policy for Robert. The checkbook analysis that follows shows the costs of these policies.

Susan’s job requires her to travel throughout her six-state region. Bendigo has an accountable reimbursement plan from which Susan receives $8,500 for the following expenses:

In April, Susan and Robert go the racetrack with Susan’s client Annie and her husband.

After wagering $170 without winning, Susan wins $2,600 on the last race.

The racetrack withholds $780 for federal income taxes and $260 for state income taxes.

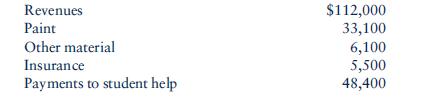

Robert hires college students to help him paint houses. This year, he is able to hire 8 students (two 4-person crews). Robert shuttles between sites, supervising the jobs, talking to prospective clients, and painting. He treats the college students as independent contractors. His business generates the following income and expenses:

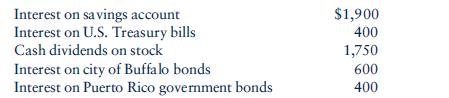

During the year, Robert and Susan receive the following portfolio income:

Robert and Susan own 3,000 shares of qualified small business stock that they purchased in 2001 for $37,000. Early in 2010 they sell all the shares for $16,800.

Robert and Susan also sell 100 shares of Sobey Corporation stock for a short-term capital gain of $3,500 and 250 shares of the Bristol Corporation for a long-term capital loss of $7,250. They pay investment interest of $550 during the year.

Robert and Susan own a 4% interest in a limited partnership. The limited partnership reports the following information to them:

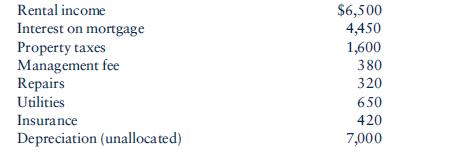

During the year, the family spends 20 days at its summer home; they rent it to vacationers for 80 days. Information pertaining to the rental is as follows:

One night, while returning home from a parent-teacher conference at school, Robert is involved in an automobile accident and is hospitalized for 7 days. He incurs $14,000 in medical expenses. His employer-provided policy reimburses him $11,800 of the costs. In addition, his disability policy pays him $3,200 for the time he misses from school.

The car is totally destroyed. It was purchased in 2008 for $19,500, and Robert finds a similar car selling for $8,000. The insurance company reimburses him $6,700.

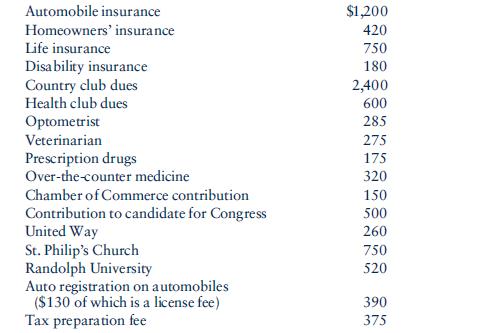

An analysis of Susan and Robert’s checkbook reveals the following payments in 2010:

During 2010, Robert and Susan take out a $33,000 home equity loan that they use to pay off $8,000 in credit card debt. The remaining loan proceeds go to renovating the house. Interest paid on this loan totals $1,950 during 2010. Robert and Susan purchased their current home by paying $16,000 down and signing a $160,000 mortgage note, secured by the home. The home is worth $225,000, and the balance on the original mortgage is $134,000. They pay interest on their home mortgage of $14,700 during 2010. They also pay $310 in interest on their personal credit cards and $1,720 in property taxes on their home during 2010.

Compute Robert and Susan’s taxable income for 2010, the tax on this income, and the amount of any refund or additional tax due. You should provide a summary schedule of these calculations (in proper form) with a supplemental discussion of the treatment of each item given in the facts. If an item does not affect their taxable income calculation, you should discuss why it doesn’t enter into the computation.

If you are using tax forms to solve this problem, you will need the following forms and schedules: Form 1040, Schedule A, Schedule B, Schedule C, Schedule D, Schedule E, Form 2106, Form 4684, and Form 8606. In addition, you should obtain a copy of the Form 1040 instructions to help you prepare the tax return.

Step by Step Answer:

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins