In integrative problem 85 in Chapter 4, you were asked to calculate Carmins gross income for 2010.

Question:

In integrative problem 85 in Chapter 4, you were asked to calculate Carmin’s gross income for 2010. This is the second phase, which provides the additional information necessary for you to calculate her taxable income, income tax liability, and additional tax (or refund due). NOTE: The gross income items from problem 85 still apply. However, some additional items might affect the amount of gross income that Carmin must report. That is, several items included in the gross income from integrative problem 85 are either not reported as gross income or need to be combined with the additional information in this problem to determine the correct treatment. Therefore, you should make the appropriate adjustments to gross income in integrative problem 85, and begin your tax calculation under the heading of Gross Income from Problem 85, As Adjusted.

From this point on, any items of gross income from the information in this problem should be listed to determine gross income for tax purposes. You do not need to list all the individual gross income items from integrative problem 85 in your solution.

However, you should explain the adjustments made to the phase 1 gross income figure as part of your discussion of the solution.

Carmin has the following amounts withheld from her paycheck for the payment of state income taxes, federal taxes, and Social Security taxes:

In addition, Carmin makes timely federal estimated tax payments of $400 per quarter and estimated state tax payments of $150 per quarter. To minimize her tax liability, she makes her last estimated state tax payment on December 31, 2010.

Because of her busy work schedule, Carmin is unable to give her accountant the tax documents necessary for filing her 2009 state and federal income tax return by the due date (April 15, 2010). In filing her extension on April 15, 2010, she makes a state tax payment of $245 and a federal tax payment of $750. Her return is eventually filed on June 25, 2010. In August 2010, she receives a federal refund of $180 and a state tax refund of $60.

Carmin pays $1,980 in real estate taxes on her principal residence. The real estate tax is used to pay for town schools and other municipal services. The town also has 5 fire districts, which levy a separate tax (i.e., fire tax) to fund each district’s fire department. The fire tax is based on the assessed value of the taxpayer’s home.

Carmin pays $170 in fire tax during the year.

Carmin drives a 2009 Tarago 919 Wagon. Her car registration costs $50 and covers the period 1/1/10 through 12/31/10. In addition, she pays $280 in property tax to the town, based on the book value of the car.

In addition to the medical costs presented in problem 85 in Chapter 4, Carmin incurs the following unreimbursed medical costs:

On March 1, Carmin takes advantage of low interest rates and refinances her $75,000 home mortgage. The new home loan is for 15 years. Carmin and her exhusband paid $90,000 for the house in 1999. The house is worth $155,000. She pays $215 in closing costs and $1,800 in points to obtain the loan. As part of the refinancing arrangement, she also obtains a $10,000 home equity loan. She uses the proceeds from the home equity loan to remodel the kitchen and bathroom and to reduce the balances on her credit cards. Her home mortgage interest for the year is $6,500, and her home equity loan interest is $850. She incurs interest on her Chargit credit card of $410 and $88 on her Myers Department Store card. The interest on her car loan from Tarago Financing Corporation is $350.

Carmin receives the following information on her investment in Grubstake Mining and Development:

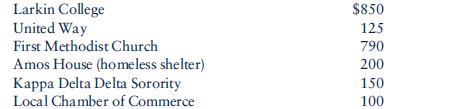

In May 2010, she contributes clothing to the Salvation Army. The original cost of the clothing was $740. She receives a statement from the Salvation Army valuing the donation at $360. In addition, she makes the following cash contributions:

Carmin sells real estate in the evenings and on weekends. She runs the business from a 600-square-foot office in her basement. She has been operating in a businesslike way since April 2001 and has always shown a profit. She has the following income and expenses from her business:

Carmin has a separate telephone line to her office. The $550 telephone cost includes a $30 monthly fee and $190 in long-distance calls related to her business.

Carmin uses her car in her business and properly documents 8,000 businessrelated miles. The business and personal use of her car during the year total 20,000 miles. In 2009, Carmin elected to use the standard mileage method to calculate her car expenses. She spends $85 on tolls and $225 on parking related to her real estate business.

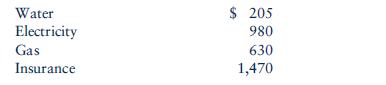

Carmin incurs the following expenses in operating her home:

The living area of Carmin’s house (not including the basement) measures 2,400 square feet. When she started her business in April 2002, the fair market value of the house was $100,000. Approximately 10% of the purchase price is attributable to the land. Depreciation on the house (unallocated) for 2010 would be $2,077.

In April, Carmin’s house is robbed. She apparently interrupted the burglar because all that’s missing is an antique brooch she inherited from her grandmother and $300 in cash. Unfortunately, she didn’t have a separate rider on her insurance policy covering the jewelry. Therefore, the insurance company reimburses her only $500 for the brooch. When her grandmother died in 2007, the fair market value of the pin was $6,000. The fair market value of the pin at the date of the theft is $7,500.

Her insurance policy also limits to $100 the amount of cash that can be claimed in a theft.

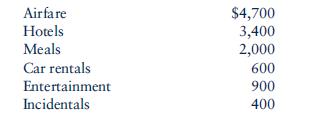

Carmin’s company has an accountable employee expense reimbursement plan from which Carmin receives $10,800 for the following expenses:

During the year, she also pays $295 for business publications and $775 for a local accountant to prepare her 2009 tax return. The bill from the accountant indicated that preparation of the business portion of Carmin’s return cost $550.

In 2008, Carmin loaned $10,000 to her ex-husband Ray so he could start a new business. Their loan agreement requires Ray to pay Carmin 8% interest on the unpaid balance of the loan on December 31 of each year and to begin repaying the loan in $2,500 annual installments on July 1, 2010. Carmin receives the interest on the loan during 2008 and 2009. In March 2010, she receives a letter informing her that Ray has filed for bankruptcy. On February 22, 2011, the bankruptcy court awards all creditors 40% of their claims on Ray’s assets.

Calculate Carmin’s taxable income, income tax liability, and tax (or refund) due on her 2010 tax return. Then do one or both of the following, according to your professor’s instructions:

a. Include a brief explanation of how you determined each deduction and any item you did not treat as a deduction. Your solution to the problem should contain a list of each deduction and its amount, with the explanations attached.

b. Write a letter to Carmin explaining how you determined each deduction and any items you did not treat as a deduction. You should include a list of each deduction and its amount.

Step by Step Answer:

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins