Lee and Ben own a winter retreat in Harlingen, Texas, that qualifies as their second home This

Question:

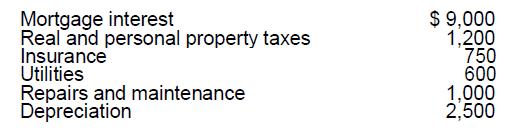

Lee and Ben own a winter retreat in Harlingen, Texas, that qualifies as their second home This year they spent 40 days in their cabin. Because of its ideal location, it is easy to rent at $120 a day and was rented for 80 days this year. The total upkeep costs of the cabin for the year were as follows:

What is the proper treatment of this information on Lee and Ben's tax return? (Round percentages to 4 decimals)

Transcribed Image Text:

Mortgage interest Real and personal property taxes Insurance Utilities Repairs and maintenance Depreciation $ 9,000 1,200 750 600 1,000 2,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 87% (8 reviews)

Because the personal use of the home exceeds 14 days the home is a vacation home and deductions are ...View the full answer

Answered By

Muhammad adeel

I am a professional Process/Mechanical engineer having a vast 7 years experience in process industry as well as in academic studies as a instructor. Also equipped with Nebosh IGC and lead auditor (certified).

Having worked at top notch engineering firms, i possess abilities such as designing process equipment, maintaining data sheets, working on projects, technical biddings, designing PFD and PID's etc.

Having worked as an instructor in different engineering institutes and have been involved in different engineering resrearch projects such as refinery equipment designing, thermodynamics, fluid dynamics, chemistry, rotary equipment etc

I can assure a good job within your budget and time deadline

4.90+

52+ Reviews

60+ Question Solved

Related Book For

Concepts In Federal Taxation 2022

ISBN: 9780357515785

29th Edition

Authors: Kevin E. Murphy, Mark Higgins, Tonya K. Flesher

Question Posted:

Students also viewed these Business questions

-

Lee and Sally own a winter retreat in Harlingen, Texas, that qualifies as their second home. This year they spent 40 days in their cabin. Because of its ideal location, it is easy to rent at $120 a...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Delivery Service purchased a commercial umbrella policy with a $10 million liability limit and a $100,000 self-insured retention. The umbrella insurer required Delivery Service to carry a $1 million...

-

The director of cost management for Portland Instrument Corporation compares each months actual results with a monthly plan. The standard direct-labor rates for the year just ended and the standard...

-

How would you respond to someone who made the following statement: 'Organisational cultures are not important as far as business is concerned'?

-

P8-9 Workpaper (noncontrolling interest, preacquisition income, downstream sale of equipment, upstream sale of land, subsidiary holds parents bonds) Pam Corporation paid $175,000 for a 70 percent...

-

Baylor University sold 10,000 season football tickets at $80 each for its five-game home schedule. What entries should be made (a) When the tickets were sold, and (b) After each game?

-

If Sloane Joyner invests $10,514.81 now and she will receive $30,000 at the end of 11 years, what annual rate of interest will she be earning on her investment? 8% 8.5% 9% O 10%

-

In one year, one dollar ($1) could be exchanged for one euro and twenty cents (1.20). a. Derive a formula to exchange dollars into euros. Let d be the number of dollars. Let e be the number of euros....

-

Haysad owns a house on Lake Tahoe. He uses a real estate firm to screen prospective renters, but he makes the final decision on all rentals. He also is responsible for setting the weekly rental price...

-

As a hobby, Salome creates and sells oil paintings. During the current year, her sales total $8,000. How is the tax treatment of her hobby different from the treatment of a trade or business, if a....

-

Plot each point in a rectangular coordinate system. (-3, -2)

-

10.) Steam enters a well-insulated turbine at 6 MPa, 400C and expands to 200 kPa, saturated vapor at a rate of 10 kg/s. (a) Draw a schematic of the process (5 pts). (b) Determine the exergy...

-

4. [8 marks] The tides in the Bay of Fundy are some of the largest in the world. The height, h(t), of the tide in meters after t hourse can be modeled by 39 h(t) = 25 con (77) + 30 4 COS 6 (a) What...

-

Wolfe, Inc. had credit sales for the period of $144,000. The balance in Allowance for Doubtful Accounts is a debit of $653. If Wolfe estimates that 2% of credit sales will be uncollectible, what is...

-

Water at 20C is to be pumped from a reservoir (ZA = 5 m) to another reservoir at a higher elevation (ZB = 13 m) through two 36-m- long pipes connected in parallel as shown. The pipes are made of...

-

Delph Company uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 53,000 machine-hours would...

-

Using the scenarios in case Exhibit 9, what role does leverage play in affecting the return on equity (ROE) for CPK? What about the cost of capital? In assessing the effect of leverage on the cost of...

-

Sheldon and Leonard had a million-dollar idea. In order to make it happen, they have to do special research first. Only Kripke can help them in this matter. But Kripke is known to be the first-class...

-

Anton is single and a self-employed plumber. His net income from his business is $56,000. He has dividend income of $6,000 and an $8,000 loss from a rental property in which he actively participates....

-

Rita is the sole owner of Video Plus, a local store that rents video games, software, and movies. She works 40 hours a week managing the store. Identify the tax issue(s) posed by the facts presented....

-

Margery owns a passive activity with a basis of $15,000. The activity has a $9,000 suspended loss. Margery sells the passive activity for $22,000. Identify the tax issue(s) posed by the facts...

-

explain the concept of Time Value of Money and provide and example. In addition to your discussion, please explain the differences between Stocks and Bonds

-

Wildhorse Inc. has just paid a dividend of $3.80. An analyst forecasts annual dividend growth of 9 percent for the next five years; then dividends will decrease by 1 percent per year in perpetuity....

-

Jenny wanted to donate to her alma mater to set up a fund for student scholarships. If she would like to fund an annual scholarship in the amount of $6,000 and her donation can earn 5% interest per...

Study smarter with the SolutionInn App