LO1 The Viking Corporation has the following items of income for 2010: a. Calculate the corporations 2010

Question:

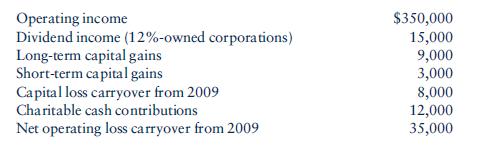

LO1 The Viking Corporation has the following items of income for 2010:

a. Calculate the corporation’s 2010 taxable income and its tax liability.

b. Assume that Viking is, and always has been, an S corporation wholly owned by Fran, a single taxpayer with no other income or deductions. Will either Viking Corporation or Fran realize any tax savings, given the income and liability determined in part a? Explain.

Communication Skills

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted: