LO2 Cassandra owns her own business and drives her van 15,000 miles a year for business and

Question:

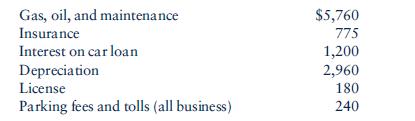

LO2 Cassandra owns her own business and drives her van 15,000 miles a year for business and 5,000 miles a year for commuting and personal use. She purchases a new van in 2010 and wants to claim the largest tax deduction possible for business use. Cassandra’s total auto expenses for 2010 are as follows:

Determine Cassandra’s 2010 deduction for business use of the van.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted: