LO7 Ray, 83, is a used car dealer. He lives in a rural community and operates the

Question:

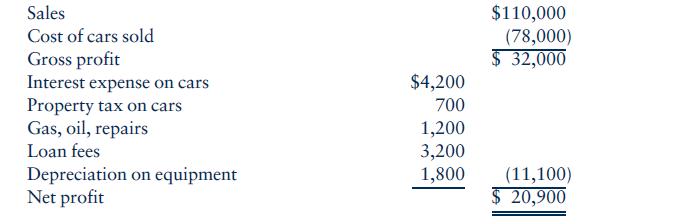

LO7 Ray, 83, is a used car dealer. He lives in a rural community and operates the business out of his home. One room in his 6-room house is used exclusively for his business office. He parks the cars in his front yard, and when customers come along, they sit on the front porch and negotiate a sale price. The income statement for Ray’s auto business is as follows:

If Ray’s home were rental property, the annual depreciation would be $2,900. The utilities and upkeep on the home cost Ray $6,400 for the year. Ray’s mortgage interest for the year is $2,400. When asked about the loan fees, Ray bitterly responds that Jim, the bank loan officer, charges him 10% of his gross profit on cars financed through the bank. Ray says, ‘‘The money is under the table, and if I don’t shell out the cash, Jim won’t loan the money to my customers to buy my cars. Everybody goes to Jim—

he’s got the cash.’’

Write a letter to Ray explaining the proper treatment of this information on his tax return.

Step by Step Answer:

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins