LO7 Charlotte owns a custom publishing business. She uses 500 square feet of her home (2,000 square

Question:

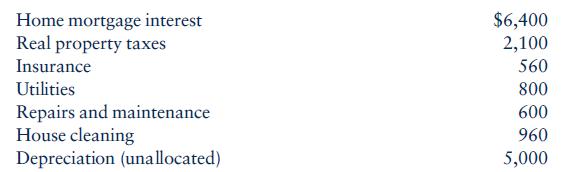

LO7 Charlotte owns a custom publishing business. She uses 500 square feet of her home (2,000 square feet) as an office and for storage. All her business has come from telemarketing (telephone sales), direct mailings, or referrals. In her first year of operation, she has revenues of $37,000, cost of goods sold of $25,900, and other business expenses of $8,100. The total expenses related to her home are:

What amount can Charlotte deduct for her home office?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted: