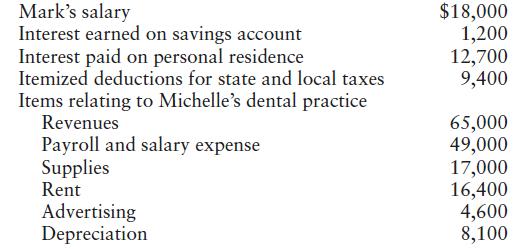

Michelle and Mark are married and file a joint return. Michelle owns an unincorporated dental practice. Mark

Question:

Michelle and Mark are married and file a joint return. Michelle owns an unincorporated dental practice. Mark works part-time as a high school math teacher, and spends the remainder of his time caring for their daughter. During 2023, they report the following items:

a. What is Michelle and Mark’s taxable income or loss for the year?

b. What is Michelle and Mark’s NOL for the year?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson

Question Posted: