Newcastle Corporation was incorporated in 2017. For the years 2017 through 2019, Newcastle has the following net

Question:

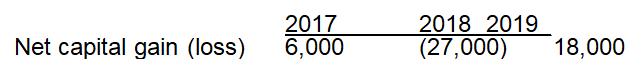

Newcastle Corporation was incorporated in 2017. For the years 2017 through 2019, Newcastle has the following net capital gain or loss.

If Newcastle is in the 34% marginal tax bracket for each of these years, what effect do the net capital gains (losses) have on its tax liability for 2017, 2018, and 2019?

Transcribed Image Text:

Net capital gain (loss) 2017 6,000 2018 2019 (27,000) 18,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

Net capital gains are subject to the corporate tax at regular tax rates Net capital losses cannot be deducted in the year of the loss Losses are carried back three years and forward five years and used to offset net capital gains in the carryover period Carrybacks result in a tax refund Carryforwards reduce the tax paid in future periods on net capital gains Part of the 2018 loss is carried back to 2017 and a 2040 6000 x 34 refund is obtained The remaining 2018 loss of 21000 27000 6000 is carried forward to 2019 to offset the entire capital gain in 2019 The remaining 3000 21000 18000 of 2018 capital loss ...View the full answer

Answered By

John Aketch

I have a 10 years tutoring experience and I have helped thousands of students to accomplish their educational endeavors globally. What interests me most is when I see my students being succeeding in their classwork. I am confident that I will bring a great change to thins organization if granted the opportunity. Thanks

5.00+

8+ Reviews

18+ Question Solved

Related Book For

Concepts In Federal Taxation

ISBN: 9781337702621

26th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted:

Students also viewed these Business questions

-

Newcastle Corporation was incorporated in 2019. For the years 2019 through 2021, Newcastle has the following net capital gain or loss. If Newcastle is in the 21 percent marginal tax bracket for each...

-

Newcastle Corporation was incorporated in 2010. For the years 2010 through 2012, Newcastle has the following net capital gain or loss. If Newcastle is in the 34% marginal tax bracket for each of...

-

Newcastle Corporation was incorporated in 2020. For the years 2020 through 2022, Newcastle has the following net capital gain or loss. If Newcastle is in the 21% marginal tax bracket for each of...

-

Write a static method lg() that takes an int argument n and returns the largest integer not larger than the base-2 logarithm of n. Do not use the Math library.

-

How does the concept of consistency aid in the analysis of financial statements? What type of accounting disclosure is required if this concept is not applied?

-

Which one of the following methods of compensating aircraft salespersons is the most popular? a. salary 100% c. salary 30%, commission 70% b. salary 70%, commission 30% d. commission 100%

-

Describe various company strategies to manage government intervention. LO.1

-

The following transitions occurred for London Engineering: Journalize the transactions of London Engineering. Include an explanation with each journal entry. Use the following accounts: Cash;...

-

On October 1 of the current year, Molloy Corporation prepared a cash budget for October, November, and December. All of Molloy's sales are made on account. The following information was used in...

-

Sheila was frustrated. Although she was happy with both the topic and the constructs she had chosen to examine in her senior honors thesis, she had hit several roadblocks in determining what measures...

-

Sonya, who is single, owns 20,000 shares of Malthouse Corporation stock. She acquired the stock in 2015 for $75,000. On August 12, 2018, Sonyas father tells her of a rumor that Malthouse will file...

-

Bongo Corporation is incorporated in 2016. It has no capital asset transactions in 2016. From 2017 through 2020, Bongo has the following capital gains and losses: Assuming that Bongo's marginal tax...

-

If a firm has the following sources of finance, Current liabilities....... $100,000 Long-term debt....... 350,000 Preferred stock....... 75,000 Common stock....... 225,000 Earns a profit of $35,000...

-

Everyone at some point has had issues with time management and procrastination in their work life, academic life and social life. How have you been handling time management issues in your life? Have...

-

You want to make three peanut butter and jelly sandwiches. What is the best way to make them that's consistent with an agile mindset? Create a sandwich assembly line, applying all the peanut butter...

-

1 pts Joan Reed exchanges commercial real estate that she owns for other commercial real estate, plus $50,000 cash. The following additional information pertains to this transaction: Property given...

-

It is believed that 86% of Padres fans would have liked Trevor Hoffman to remain in San Diego to finish out his career as a San Diego Padre. You would like to simulate asking 10 Padres fans their...

-

The videos below cover why American higher education, including public colleges and universities, is so expensive. They also explore factors that have resulted in the current student loan debt...

-

Tulum Inc. makes a Mexican chocolate mix. Budgeted direct labor hours for the first 3 months of the coming year are: January.................................9,880...

-

What is a manufacturing system?

-

Joy incurs the following expenses in her business. When can she deduct the expenses if she uses the accrual method of accounting? The cash method? a. Joy rents an office building for $750 a month....

-

The Parr Corporation incurs the following expenses. When can it deduct the expenses if it uses the accrual method of accounting? The cash method? a. Parr Corporation mails a check for $5,000 to the...

-

Kai, a cash basis taxpayer, is a 75% owner and president of Finnigan Fish Market. Finnigan, an S corporation, uses the accrual method of accounting. On December 28, 2016, Finnigan accrues a bonus of...

-

Problem 12.6A (Algo) Liquidation of a partnership LO P5 Kendra, Cogley, and Mel share income and loss in a 3.21 ratio (in ratio form: Kendra, 3/6: Cogley, 2/6; and Mel, 1/6), The partners have...

-

Melody Property Limited owns a right to use land together with a building from 2000 to 2046, and the carrying amount of the property was $5 million with a revaluation surplus of $2 million at the end...

-

Famas Llamas has a weighted average cost of capital of 9.1 percent. The companys cost of equity is 12.6 percent, and its cost of debt is 7.2 percent. The tax rate is 25 percent. What is the companys...

Study smarter with the SolutionInn App