Bongo Corporation is incorporated in 2016. It has no capital asset transactions in 2016. From 2017 through

Question:

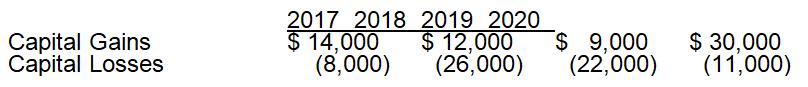

Bongo Corporation is incorporated in 2016. It has no capital asset transactions in 2016. From 2017 through 2020, Bongo has the following capital gains and losses:

Assuming that Bongo's marginal tax rate during each of these years is 34%, what is the effect of Bongo's capital gains and losses on the amount of tax due each year?

Transcribed Image Text:

Capital Gains Capital Losses 2017 2018 2019 2020 $ 14,000 $12,000 (26,000) (8,000) $ 9,000 $ 30,000 (22,000) (11,000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (7 reviews)

The gains and losses must be netted together Net capital gains are subject to the corpor...View the full answer

Answered By

Michael Mulupi

I am honest,hardworking, and determined writer

4.70+

72+ Reviews

157+ Question Solved

Related Book For

Concepts In Federal Taxation

ISBN: 9781337702621

26th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted:

Students also viewed these Business questions

-

The is independent of both oftware and hardware. O a. None of the choices are true. O b. Quality model O c. Internal model O d. External model

-

Bongo Corporation is incorporated in 2014. It has no capital asset transactions in 2014. From 2015 through 2018, Bongo has the following capital gains and losses: Assuming that Bongo's marginal tax...

-

Bongo Corporation is incorporated in 2009. It has no capital asset transactions in 2009. From 2010 through 2013, Bongo has the following capital gains and losses: Assuming that Bongos marginal tax...

-

Write a static method max3() that takes three int arguments and returns the value of the largest one. Add an overloaded function that does the same thing with three double values.

-

A Boston-based middle manager recently received an exciting e-mail offer from American Airlines. Because of her long-time loyalty, she is eligible to obtain LIFETIME Platinum elite status on American...

-

When designing a compensation plan, the first step is to a. determine the total sales for the year. b. determine the impact of turnover. c. establish the level of earnings required to support an...

-

What are the roles of FDI, licensing, and joint ventures in reducing the impact of import tariffs? LO.1

-

You run a regression of monthly returns of Mapco, an oil-and gas-producing firm, on the S&P 500 Index and come up with the following output for the period 19911995. Intercept of the regression =...

-

ASAP final Meiji Isetan Corp. of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow (In millions of yen, denoted by: Sales Net...

-

Jamie Lee Jackson, age 26, is in her last semester of college and is anxiously waiting for graduation day that is just around the corner! She still works part-time as a bakery clerk, has been...

-

Newcastle Corporation was incorporated in 2017. For the years 2017 through 2019, Newcastle has the following net capital gain or loss. If Newcastle is in the 34% marginal tax bracket for each of...

-

Goldie sells 600 shares of Bear Corporation stock for $9,000 on December 14, 2018. She paid $27,000 for the stock in February 2015. a. Assuming that Goldie has no other capital asset transactions in...

-

For decades, researchers, politicians, and tobacco company executives debated the relation between smoking and health problems such as cancer. a. Why was this research necessarily correlational in...

-

Write a function that takes as input a non-negative integer in the range 0 to 99 and returns the English word(s) for the number as a string. Multiple words should be separated by a space. If the...

-

The Event Manager sighed as the festival approached and she had only five crafts vendors who had committed to taking part in the marketplace. She and her assistant were frantic. They had been...

-

the systematic recording, analysis, and interpretation of costs incurred by a business. Its significance extends beyond mere financial tracking; it plays a pivotal role in aiding management...

-

1.What is your process for ensuring that all your work is correct? 2.What do you mean by Batch Costing ? 3.Explain the accounting procedure for Batch Costing 4.State the applicability of Job Costing...

-

The increasing occurrence of freak weather incidents will have both local and global effects. Even in cases where production has been re-localized, freak weather can still greatly impact local...

-

Tulum Inc. makes a Mexican chocolate mix. Planned production in units for the first 3 months of the coming year is: January......................24,700 February.....................22,000...

-

In the operation of an automated production line with storage buffers, what does it mean if a buffer is nearly always empty or nearly always full?

-

Lonnie owns 100% of Quality Company's common stock. Lonnie, the president of Quality, is a cash basis taxpayer. Quality is short of cash as of December 31, 2016, the close of its tax year. As a...

-

The Showgate Hotel Casino is an accrual basis taxpayer and maintains its records on a calendar year. It has 3,000 slot machines, one of them a progressive machine whose jackpot increases based on the...

-

During the current year, Benjamin and Valerie were notified that their 2014 tax return was being audited. The IRS commissioner has disallowed all the losses attributable to Valerie's cattle breeding...

-

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company...

-

Brief Exercise 10-6 Flint Inc. purchased land, building, and equipment from Laguna Corporation for a cash payment of $327,600. The estimated fair values of the assets are land $62,400, building...

-

"faithful respresentation" is the overriding principle that should be followed in ones prepaparation of IFRS-based financial statement. what is it? explain it fully quoting IAS. how this this...

Study smarter with the SolutionInn App