Rufus and Rhonda are a married couple with 3 dependent children, all under 16 years of age.

Question:

Rufus and Rhonda are a married couple with 3 dependent children, all under 16 years of age. Rufus, 46, is an executive with Plowshare Corporation. Rhonda, 39, is a self-employed attorney.

Rufus receives an annual salary of $78,000. He participates in Plowshare’s qualified pension plan by contributing 4% of his annual salary, which is matched by Plowshare. Rufus also receives group term life insurance at twice his annual salary.

The coverage costs Plowshare $2,100. All employees are covered by a medical insurance policy. (Rufus’s policy costs $2,300.) He also participates in the company’s flexible benefits plan by paying $200 per month into the plan. During the year, Rufus submits claims totaling $1,800 to the plan. An additional benefit that only top-level executives such as Rufus enjoy is the payment of $2,300 in country club dues by Plowshare. Although Rufus occasionally entertains clients at the club, his primary use of the facility is personal.

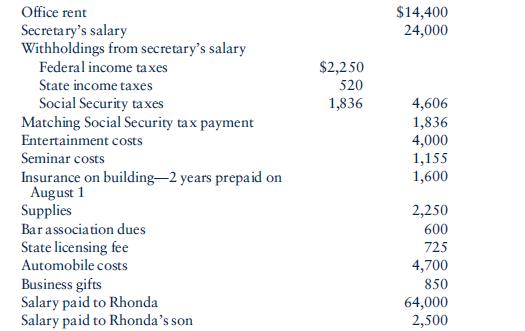

Rhonda bills clients a total of $125,000 for services rendered during the current year. She receives $17,000 in payments from billings in prior years and $87,000 from current-year billings. Rhonda pays the following expenses related to her legal practice:

In addition to these out-of-pocket costs, Rhonda determines that $2,400 in accounts receivable from previous years’ billings are uncollectible.

The entertainment costs consist of the following:

Rhonda has records that show that she uses the club 70% of the time for entertainment directly related to business, 10% for entertainment associated with her business, and 20% for personal purposes. The open house costs consist of $1,400 for food and $400 for a jazz combo at a reception she hosted for clients when she moved into her new offices this year.

Rhonda uses her automobile extensively in her business. She keeps a log to record business miles and related costs. Her records show that she drove 10,000 business miles and 3,000 personal miles during the current year. In past years, she had always kept track of her business miles but failed to keep an accurate record of her actual costs. Accordingly, her records indicate that she has never depreciated any of the $26,000 cost of the automobile she purchased 2 years ago—she has used the standard mileage rate method.

Every year, Rhonda gives her top 8 clients a gift to thank them for their support of her practice. This year, she gives each client a marble paperweight engraved with the client’s name. Each paperweight costs $75 plus $5 for engraving and $5 for gift wrapping.

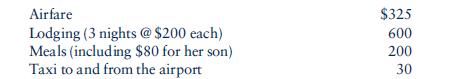

The seminar costs relate to a 3-day meeting in New York on a legal topic involving her biggest client. Because of a special airline promotion, she takes along her 16-

year-old son free. However, she has to pay $200 per night for her hotel room instead of the $175 per night single rate. A summary of the seminar costs is as follows:

Rhonda pays the $2,500 salary to her son for cleaning up after the open house reception. Although she could hire a service to do the job for $400, he needs the money to buy a used motorcycle.

Rufus is hit by a car one morning while he is out jogging. The driver is at fault, and his insurance company pays Rufus $8,000 for his pain and suffering and $13,000 of his $15,500 medical expenses. The remaining medical expenses are paid by Plowshare’s medical insurance policy. Rufus also receives $2,650 in disability pay from the Plowshare policy for the time he misses from work recovering from the injury.

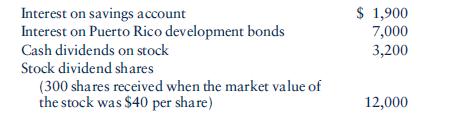

Rufus and Rhonda have the following investment-related items during the current year:

Early in the year, Rhonda inherits 900 shares of stock from her grandmother.

The total value of the shares is $16,000. Later in the year, the stock value begins to fall rapidly, and she sells the shares at a $4,500 loss.

Rufus and Rhonda own a cabin in the mountains. They use it on weekends and for short holidays and rent it out whenever they can. During the current year, they use the cabin 25 days and rent it out 75 days. Details on the cabin income and expenses are as follows:

In addition, Rufus and Rhonda have $19,220 in other allowable itemized deductions. Based on the information provided, calculate Rufus and Rhonda’s taxable income and their tax liability. Assume that they are cash basis taxpayers and want to be as aggressive as possible in taking their allowable deductions.

Step by Step Answer:

Concepts In Federal Taxation 2011

ISBN: 9780538467926

18th Edition

Authors: Kevin E. Murphy, Mark Higgins