The Kimpton Corporation pays the following taxes during 2018: Also, the county treasurer notifies Kimpton that it

Question:

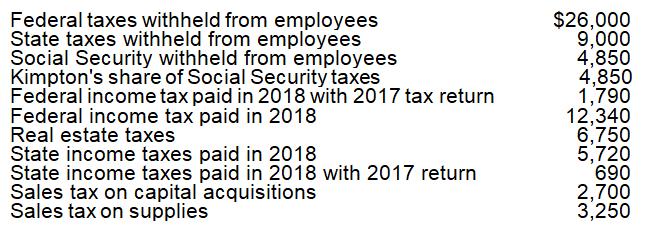

The Kimpton Corporation pays the following taxes during 2018:

Also, the county treasurer notifies Kimpton that it is being assessed a special real estate tax of $64,000 for upgrading the sidewalks and sewer connections in the area. The special tax is payable in 4 yearly installments of $16,000. What amount can Kimpton deduct for taxes paid in 2018?

Transcribed Image Text:

Federal taxes withheld from employees State taxes withheld from employees Social Security withheld from employees Kimpton's share of Social Security taxes Federal income tax paid in 2018 with 2017 tax return Federal income tax paid in 2018 Real estate taxes State income taxes paid in 2018 State income taxes paid in 2018 with 2017 return Sales tax on capital acquisitions Sales tax on supplies $26,000 9,000 4,850 4,850 1,790 12,340 6,750 5,720 690 2,700 3,250

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

The Kimpton Corporation can only deduct the taxes that it actually paid in 2018 As an employer Kim...View the full answer

Answered By

GERALD KAMAU

non-plagiarism work, timely work and A++ work

4.40+

6+ Reviews

11+ Question Solved

Related Book For

Concepts In Federal Taxation

ISBN: 9781337702621

26th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted:

Students also viewed these Business questions

-

The Kimpton Corporation pays the following taxes during 2016: Federal taxes withheld from employees ................................ $26,000 State taxes withheld from employees...

-

The Kimpton Corporation pays the following taxes during 2021: Also, the county treasurer notifies Kimpton that it is being assessed a special real estate tax of $64,000 for upgrading the sidewalks...

-

The Kimpton Corporation pays the following taxes during 2011: Federal taxes withheld from employees ........ $26,000 State taxes withheld from employees .......... 9,000 Social Security withheld from...

-

Write a program that takes two integer command-line arguments x and y and prints the Euclidean distance from the point (x, y) to the origin (0, 0).

-

When a consumer searches on Google, related advertisements (so-called sponsored links) appear next to the results. Firms bid for top placement on the page for their links. In a Google ad auction, the...

-

Merger Accounting Explain the purchase accounting method for mergers. What is the effect on cash flows? On EPS?

-

Calculate the pre-tax cost of loan capital for Lim Associates plc. ( Hint: Start with a discount rate of 10 per cent.)

-

The August 31 bank statement of Well Healthcare has just arrived from United Bank. To prepare the bank reconciliation, you gather the following data: a. The August 31 bank balance is $4,540. b. The...

-

The following transactions occurred during March 2021 for the Wainwright Corporation. The company owns and operates a wholesale warehouse 2 4. 1. Issued 30.000 shares of common stock in exchange for...

-

In this exercise you will be assuming the role of an Account Manager working within our Personal Care Appliances category during Amazon Black Friday. You act as a general manager responsible for...

-

Diane and Peter were divorced in 2018. The divorce agreement states that Peter is to have custody of their son, Stewart, and that Peter will be entitled to the dependency exemption. In addition,...

-

Dan and Katlyn are married and operate a pizza restaurant as an S corporation. In 2018, the store has qualified business income of $300,000. Their itemized deductions are $22,000 and they have other...

-

Give examples of television spots that typify the eight major types of television commercials.

-

Go to: https://www.instagram.com/ryderseyewear/ on your desktop, laptop, or mobile (or a combination of all 3). You are the new Social Media Marketing Manager for Ryders Eyewear. You've been asked...

-

As leaders, it is very important that we have the ability to assess our own motivation and the motivation of others around us. It is also important to recognize the key factors involved in...

-

At the end of this exam, you will find Article 1 - " How Companies Can Prepare for a Long Run of High Inflation ". Please read the article and, when necessary, consult additional sources and the...

-

You can develop your capabilities as a manger by better understanding different ways of motivating and rewarding employees. You can also better prepare for your own career by better understanding the...

-

Topic: Project Malasakit of Kara David https://projectmalasakit.org/ What is the pros and cons of these alternative courses of the action below: Strengthen the internal organization via promoting it...

-

Chillmax Company plans to sell 3,500 pairs of shoes at $60 each in the coming year. Unit variable cost is $21 (includes direct materials, direct labor, variable factory overhead, and variable selling...

-

Nate prepares slides for his microscope. In 1 day he prepared 12 different slides. Which equation best represents y, the total number of slides Nate prepares in x days if he continues at this rate? A...

-

Hongtao is single and has a gross income of $89,000. His allowable deductions for adjusted gross income are $4,200 and his itemized deductions are $12,900. a. What is Hongtao's taxable income and tax...

-

Paula lives in Arkansas, a state, which imposes a state income tax. During 2015, she pays the following taxes: Federal tax withheld ................................. 5,125 State income tax withheld...

-

Jesse is a resident of New Jersey who works in New York City. He also owns rental property in South Carolina. During 2016, he pays the following taxes: New Jersey state estimated tax payments...

-

Equipment with a book value of $84,000 and an original cost of $166,000 was sold at a loss of $36,000. Paid $100,000 cash for a new truck. Sold land costing $330,000 for $415,000 cash, yielding a...

-

The following is part of the computer output from a regression of monthly returns on Waterworks stock against the S&P 5 0 0 index. A hedge fund manager believes that Waterworks is underpriced, with...

-

Doisneau 25-year bonds have an annual coupon interest of 8 percent, make interest payments on a semiannual basis, and have a $1,000 par value. If the bonds are trading with a market's required yield...

Study smarter with the SolutionInn App