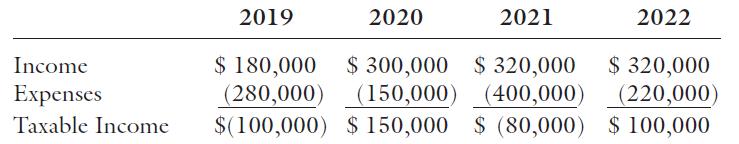

Habiby, Inc., began operations in 2019 and has the following income and expenses for 2019 through 2022.

Question:

Habiby, Inc., began operations in 2019 and has the following income and expenses for 2019 through 2022.

a. What is the amount of tax that Habiby should pay each year?

b. How much would Hadley paid in tax if the old NOL rules were in place but the corporate tax rate was 21 percent?

Transcribed Image Text:

2019 2020 2021 2022 $ 180,000 $ 300,000 $ 320,000 (150,000) (400,000) $(100,000) $ 150,000 $ (80,000) $ 100,000 $ 320,000 (220,000) Income Expenses (280,000) Taxable Income

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 69% (13 reviews)

a 2019 Habiby would pay no tax in 2019 due to its NOL for that year The NOL can be carried forward indefinitely 2020 Habiby would pay tax of 10500 21 ...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Concepts In Federal Taxation 2021

ISBN: 9780357141212

28th Edition

Authors: Kevin E. Murphy, Mark Higgins, Randy Skalberg

Question Posted:

Students also viewed these Business questions

-

The corporate income tax rates in two countries, A and B, are 40 percent and 25 percent, respectively. Additionally, both countries impose a 30 percent withholding tax on dividends paid to foreign...

-

Habiby, Inc., has the following income and expenses for 2014 through 2017. What is the amount of tax that Habiby should pay each year? Use the corporate tax rate schedules in Appendix B to compute...

-

Habiby, Inc., has the following income and expenses for 2009 through 2012. What is the amount of tax that Habiby should pay each year? Use the corporate tax rate schedules in Appendix A to compute...

-

Write a bash shell script which calculate BMI (Body Mass Intensive). The BMI formula uses your weight (in kg or pounds) and your height (in meters or inches) to form a simple calculation that...

-

For comparison purposes, mutual funds are often grouped into various categories. Do Canadian equity funds and Canadian balanced equity funds differ with respect to percentage of foreign holdings...

-

(a) Analyse the data according to the experimental design, both by analysis of variance and by mixed modelling.

-

Describe the various integrative communication channels.

-

On July 23 of the current year, Dakota Mining Co. pays $4,836,000 for land estimated to contain 7,800,000 tons of recoverable ore. It installs machinery costing $390,000 that has a 10-year life and...

-

Pureform, Inc., uses the weighted-average method in its process costing system. It manufactures a product that passes through two departments. Data for a recent month for the first department follow:...

-

The following selected information has been taken from the records of Sharp Ltd., a Canadian-controlled private corporation, for its fiscal year ended December 31, 2012. (1) Income for tax purposes:...

-

The Graves Corporation was incorporated in 2019 and incurred a net operating loss of $35,000. The companys operating income in 2020 was $47,000. Because of a downturn in the local economy, the...

-

Mort is the sole owner of rental real estate that produces a net loss of $18,000 in 2019 and $20,000 in 2020 and income of $6,000 in 2021. His adjusted gross income, before considering the rental...

-

Analysis of financial statement disclosures related to marketable securities and quality of earnings. A commercial bank reports the following information relating to its marketable securities...

-

The English statistician Karl Pearson (1857-1936) introduced a formula for the skewness of a distribution. P = 3 ( x median ) s Pearson's index of skewness Most distributions have an index of...

-

You are to specify an orifice meter for measuring the flow rate of a $35^{\circ} \mathrm{API}$ distillate $(\mathrm{SG}=0.85$ ) flowing in a $2 \mathrm{in}$. sch 160 pipe at $70^{\circ} \mathrm{F}$....

-

Let $\theta$ and $\phi$ be the polar coordinates. Introduce the complex numbers $z$ and $\bar{z}$, where $$\begin{equation*} z=e^{i \phi} \tan (\theta / 2) \equiv \xi+i \eta \tag{5.393}...

-

Suppose the profit \(P\) (in dollars) of a certain item is given by \(P=1.25 x-850\), where \(x\) is the number of items sold. a. Graph this profit relationship. b. Interpret the value of \(P\) when...

-

(a) Draw a simplified ray diagram showing the three principal rays for an object located outside the focal length of a diverging lens. (b) Is the image real or virtual? (c) Is it upright or inverted?...

-

Munnster Corporations income statements for the years ended December 31, 20X2 and 20X1, included the following information before adjustments: On January 1, 20X2, Munnster Corporation agreed to sell...

-

In Problem use absolute value on a graphing calculator to find the area between the curve and the x axis over the given interval. Find answers to two decimal places. y = x 3 ln x; 0.1 x 3.1

-

What alternatives does a producer have if it is trying to expand distribution in a foreign market and finds that the best existing merchant wholesalers wont handle imported products?

-

Discuss the future growth and nature of wholesaling if chains, scrambled merchandising, and the Internet continue to become more important. How will wholesalers have to adjust their mixes? Will...

-

Art Glass Productions, a producer of decorative glass gift items, wants to expand into a new territory. Ma n agers at Art Glass know that unit sales in the new territory will be affected by consumer...

-

Read the following and then answer the questions below:September 12: A Brisbane business offers by letter to sell 500 tyres to a New Zealand company. The Brisbane company does not specify a method of...

-

Fred returns home from work one day to discover his house surrounded by police. His wife is being held hostage and threatened by her captor. Fred pleads with the police to rescue her and offers...

-

Would like you to revisit one of these. Consideration must be clear and measurable.if you can't measure it then how can you show it has / has not been done?How can you sue someone for breach of...

Study smarter with the SolutionInn App