Question: Determine the current liabilities to net worth ratio for the commercial construction company in Figures 6-1 and 6-2 . What insight does this give you

Determine the current liabilities to net worth ratio for the commercial construction company in Figures 6-1 and 6-2 . What insight does this give you into the company’s financial operations?

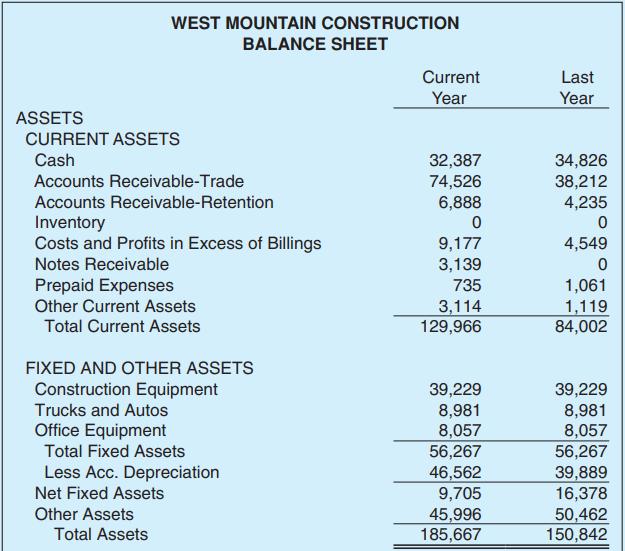

Data From Figure 6-1

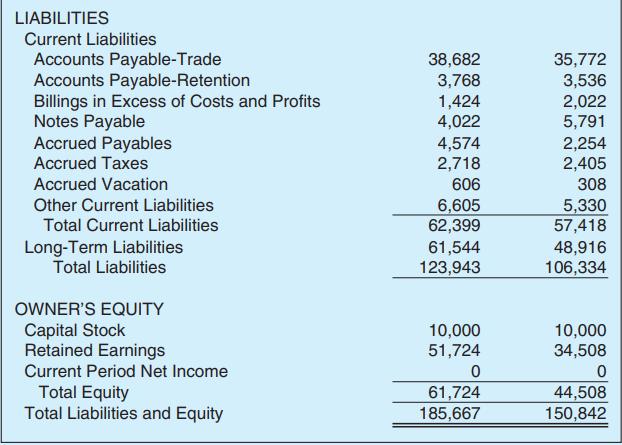

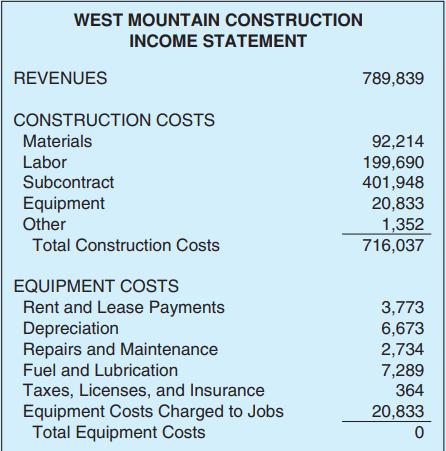

Data From Figure 6-2

WEST MOUNTAIN CONSTRUCTION BALANCE SHEET Current Last Year Year ASSETS CURRENT ASSETS Cash 32,387 34,826 Accounts Receivable-Trade 74,526 38,212 Accounts Receivable-Retention 6,888 4,235 Inventory 0 0 Costs and Profits in Excess of Billings 9,177 4,549 Notes Receivable 3,139 0 Prepaid Expenses 735 1,061 Other Current Assets 3,114 1,119 Total Current Assets 129,966 84,002 FIXED AND OTHER ASSETS Construction Equipment 39,229 39,229 Trucks and Autos 8,981 8,981 Office Equipment 8,057 8,057 Total Fixed Assets 56,267 56,267 Less Acc. Depreciation 46,562 39,889 Net Fixed Assets 9,705 16,378 Other Assets 45,996 50,462 Total Assets 185,667 150,842

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts