Question

When calculating a ratio with numbers from the balance sheet and income statement, why must you use the balance sheets from the beginning and end

When calculating a ratio with numbers from the balance sheet and income statement, why must you use the balance sheets from the beginning and end of the period covered by the income statement?

- How does retention affect the financial ratios? What ratios does it affect?

- Determine the current ratio for the commercial construction company in Figures 6-1 and 6-2. What insight does this give you into the company?s financial operations?

- Determine the fixed assets to net worth ratio for the commercial construction company in Figures 6-1 and 6-2. What insight does this give you into the company?s financial operations?

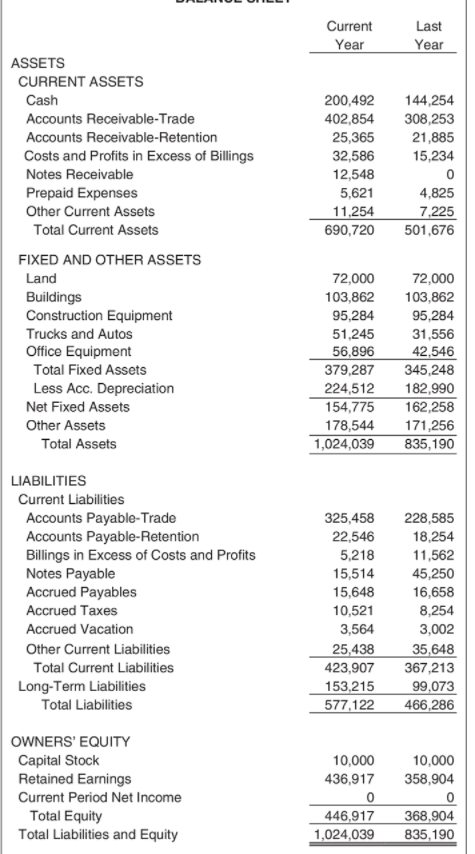

Figure 6-1 Balance Sheet for Big W Construction

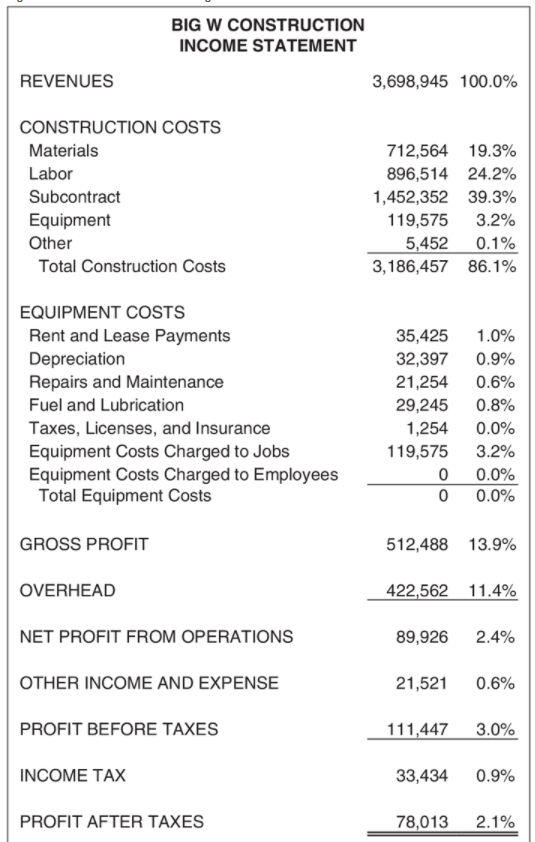

Figure 6-2 Income Statement for Big W Construction

Quick Ratio = Cash + Accounts Receivable / Current Liabilities

Current Last Year Year ASSETS CURRENT ASSETS Cash 144,254 200,492 402,854 Accounts Receivable-Trade 308,253 21,885 15,234 Accounts Receivable-Retention 25,365 Costs and Profits in Excess of Billings 32,586 Notes Receivable 12,548 Prepaid Expenses 5,621 4,825 Other Current Assets 11,254 7,225 501,676 Total Current Assets 690,720 FIXED AND OTHER ASSETS Land 72,000 72,000 103,862 Buildings Construction Equipment 103,862 95,284 95,284 Trucks and Autos 31,556 42,546 345,248 51,245 Office Equipment 56,896 Total Fixed Assets 379,287 Less Acc. Depreciation 224,512 182,990 162,258 Net Fixed Assets 154,775 Other Assets 178,544 171,256 835,190 Total Assets 1,024,039 LIABILITIES Current Liabilities Accounts Payable-Trade Accounts Payable-Retention Billings in Excess of Costs and Profits Notes Payable Accrued Payables 325,458 228,585 22,546 18,254 5,218 11,562 15,514 15,648 45,250 16,658 8,254 Accrued Taxes 10,521 Accrued Vacation 3,564 3,002 25,438 423,907 35,648 367,213 Other Current Liabilities Total Current Liabilities Long-Term Liabilities 153,215 99,073 Total Liabilities 577,122 466,286 OWNERS' EQUITY 10,000 Capital Stock Retained Earnings Current Period Net Income Total Equity Total Liabilities and Equity 10,000 436,917 358,904 446,917 1,024,039 368,904 835,190

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Current ratio current assetscurrent liabilities 690720423907 163 Current ratio shows the ability to pay short term obligations of a business which is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started