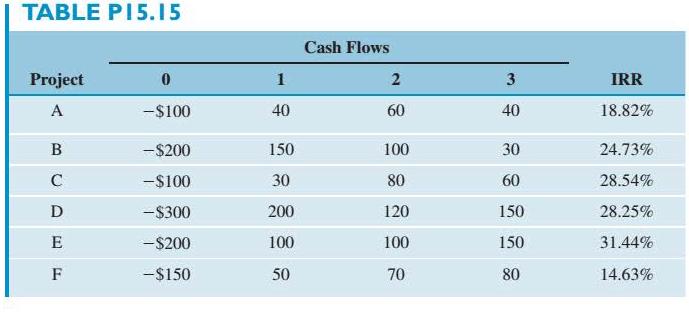

Consider the following investment projects and their interdependencies: Projects A and F are mutually exclusive.

Question:

Consider the following investment projects and their interdependencies:

• Projects A and F are mutually exclusive.

• Projects C and D are independent projects.

• Project B is contingent on Project C.

• Project E is contingent on project F.

The following indicates the cost of capital as a function of budget:

(a) Formulate the entire list of mutually exclusive decision alternatives.

(b) What is the optimal capital budget? What is the appropriate MARR for capital budgeting purpose’?

(c) If the firm has a budget limit placed at $800. which projects would be funded? What is the appropriate MARR?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: