A firm with a WACC of 10% is considering the following mutually exclusive projects: Which project would

Question:

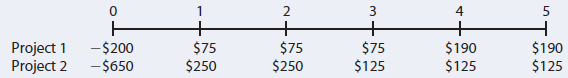

A firm with a WACC of 10% is considering the following mutually exclusive projects: Which project would you recommend? Explain.

Which project would you recommend? Explain.

Transcribed Image Text:

4 + $75 + -$200 $75 $250 $75 Project 1 Project 2 -$650 $190 $125 $190 $125 $250 $125 3.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (15 reviews)

Project 1 Using a financial calculator enter the following data CF 0 200 CF 13 75 CF 45 19...View the full answer

Answered By

Akash soni

I HAVE TAUGHT A LOT OF MY COLLEGUES . SO I CAN HEIP OTHERS WITH MY TUTORING SKILLS

0.00

0 Reviews

10+ Question Solved

Related Book For

Fundamentals of Financial Management

ISBN: 978-1337395250

15th edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted:

Students also viewed these Business questions

-

A manufacturing firm is considering the following mutually exclusive alternatives: Determine which project is a better choice at MARR = 15% on the basis of the IRR criterion. Net Cash Flow Project B...

-

The following mutually exclusive investment alter-natives have been presented to you. (See Table P6-82.) The life of all alternatives is 10 years. After the base alternative has been identified, the...

-

The following mutually exclusive investment alter-natives have been presented to you. (See Table P6-82.) The life of all alternatives is 10 years. Using a MARR of 15%, the preferred Alter-native is:...

-

In each of the homeowners forms, OA) the property coverage is the same OB) the liability coverage varies OC) both the property and liability coverage are the same OD) the property coverage varies

-

Could you get enough information from the Internet to take out a loan in another person's name?

-

What is the upper-tail critical value from the chi-square distribution if you use the Kruskal-Wallis rank test for comparing the medians in six populations at the 0.01 level of significance?

-

Explain the meaning of the term Real Accounts.

-

Describe some ethical dilemmas sales professionals may encounter. How can sales compensation programs be modified to minimize ethical dilemmas?

-

A business invests $83,200 in a project that is expected to generate $20,000 in annual cash flows at the end of each of the next seven years. What is the internal rate of return on this project?...

-

Details 1. Skill Builder Exercise - Working with PRTK This exercise requires the Mantooth and Washer case. Open the Mantooth case and Washer Case. Identify the encrypted files. Export the following...

-

A firm with a 14% WACC is evaluating two projects for this year?s capital budget. After-tax cash flows, including depreciation, are as follows: a. Calculate NPV, IRR, MIRR, payback, and discounted...

-

Project S costs $17,000, and its expected cash flows would be $5,000 per year for 5 years. Mutually exclusive Project L costs $30,000, and its expected cash flows would be $8,750 per year for 5...

-

What is a cash bonus?

-

What is the correct answer to this? SQL QUESTION Sales Data for All Customers and Products Write a query that will return sales details of all customers and products. The query should return all...

-

Below are the jersey numbers of 11 players randomly selected from a football team. Find the range, variance, and standard deviation for the given sample data. What do the results tell us? 84 18 34 3...

-

Listed below are the amounts (dollars) it costs for marriage proposal packages at different baseball stadiums. Find the range, variance, and standard deviation for the given sample data. Include...

-

The Lotto Case (Hitting the Jackpot) Allen B. Atkins, Roxanne Stell, & Larry Watkins Bob, Chad and Dylan had been dreaming of this day for the past six years; ever since they first met in an...

-

Boxplots. In Exercises 29-32, use the given data to construct a boxplot and identify the 5-number summary. Taxis Listed below are times (minutes) of a sample of taxi rides in New York City. The data...

-

Create a program that will input a positive integer from the user. The program should check to make sure the entry is a positive integer and then check to see if the number is a prime number. A prime...

-

Which of the following streaming TV devices does not involve use of a remote controller? A) Google Chromecast B) Apple TV C) Amazon Fire TV D) Roku

-

What are the two main disadvantages of discounted payback? Is the payback method of any real usefulness in capital budgeting decisions? Explain.

-

As a separate project (Project P), the firm is considering sponsoring a pavilion at the upcoming Worlds Fair. The pavilion would cost $800,000, and it is expected to result in $5 million of...

-

Use the worst-case, most likely case (or base-case), and best-case NPVs with their probabilities of occurrence to find the project's expected NPV, standard deviation, and coefficient of variation.

-

Problem 16-16 Tax Shields (LO2) River Cruises is all-equity-financed with 53,000 shares. It now proposes to issue $280,000 of debt at an interest rate of 12% and to use the proceeds to repurchase...

-

CVP Modeling project The purpose of this project is to give you experience creating a multiproduct profitability analysis that can be used to determine the effects of changing business conditions on...

-

Company ABC is thinking about a project to expand their business. In order to start the project, ABC has to invest $200,000 in new equipment and $50,000 in working capital. ABC has to spend $15,000...

Study smarter with the SolutionInn App