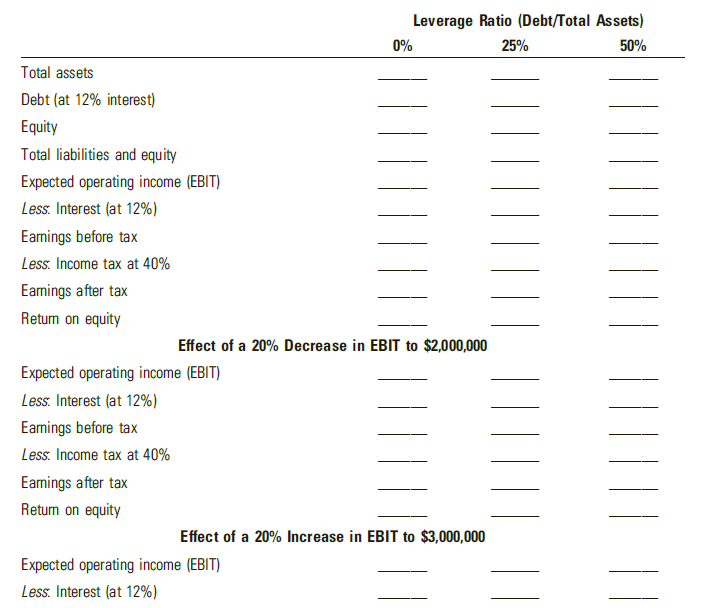

Arrow Technology, Inc. (ATI) has total assets of $10 million and expected operating income (EBIT) of $2.5

Question:

Arrow Technology, Inc. (ATI) has total assets of $10 million and expected operating

income (EBIT) of $2.5 million. If ATI uses debt in its capital structure, the cost of

this debt will be 12 percent per annum.

a. Complete the following table:

b. Determine the percentage change in return on equity of a 20 percent decrease in

expected EBIT from a base level of $2.5 million with a debt-to-total-assets ratio of:

i. 0%

ii. 25%

iii. 50%

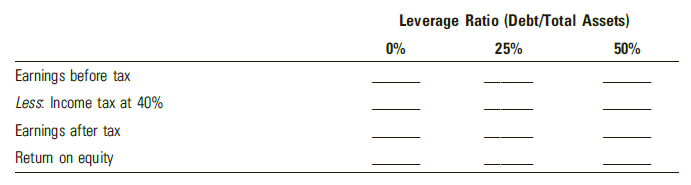

c. Determine the percentage change in return on equity of a 20 percent increase in

expected EBIT from a base level of $2.5 million with a debt-to-total-assets ratio of:

i. 0%

ii. 25%

iii. 50%

d. Which leverage ratio yields the highest expected return on equity?

e. Which leverage ratio yields the highest variability (risk) in expected return on

equity?

f. What assumption was made about the cost of debt (that is, interest rate) under

the various capital structures (that is, leverage ratios)? How realistic is this

assumption?

Step by Step Answer:

Contemporary Financial Management

ISBN: 978-1337090582

14th edition

Authors: R. Charles Moyer, James R. McGuigan, Ramesh P. Rao