The Ewing Distribution Company is planning a $100 million expansion of its chain of discount service stations

Question:

The Ewing Distribution Company is planning a $100 million expansion of its chain

of discount service stations to several neighboring states. This expansion will be

financed, in part, with debt issued with a coupon interest rate of 15 percent. The

bonds have a 10-year maturity and a $1,000 face value, and they will be sold to net

Ewing $990 after issue costs. Ewing’s marginal tax rate is 40 percent.

Preferred stock will cost Ewing 14 percent after taxes. Ewing’s common stock

pays a dividend of $2 per share. The current market price per share is $15, and

new shares can be sold to net $14 per share. Ewing’s dividends are expected to

increase at an annual rate of 5 percent for the foreseeable future. Ewing expects to

have $20 million of retained earnings available to finance the expansion.

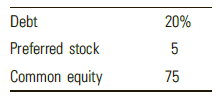

Ewing’s target capital structure is as follows:

Calculate the weighted cost of capital that is appropriate to use in evaluating this expansion program.

Step by Step Answer:

Contemporary Financial Management

ISBN: 978-1337090582

14th edition

Authors: R. Charles Moyer, James R. McGuigan, Ramesh P. Rao