The Seminole Production Company is analyzing the investment in a new line of business machines. The initial

Question:

The Seminole Production Company is analyzing the investment in a new line of

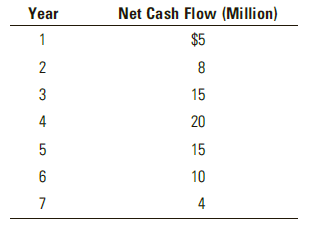

business machines. The initial outlay required is $35 million. The net cash flows

expected from the investment are as follows:

The firm’s cost of capital (used for projects of average risk) is 15 percent.

a. Compute the net present value of this project assuming it possesses average risk. •b. Because of the risk inherent in this type of investment, Seminole has decided to

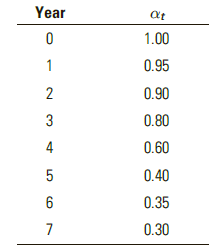

employ the certainty equivalent approach. After considerable discussion, management

has agreed to apply the following certainty equivalents to the project’s

cash flows:

If the risk-free rate is 9 percent, compute the project’s certainty equivalent net

present value.

c. On the basis of the certainty equivalent analysis, should the project be accepted?

Step by Step Answer:

Contemporary Financial Management

ISBN: 978-1337090582

14th edition

Authors: R. Charles Moyer, James R. McGuigan, Ramesh P. Rao