Two capital goods manufacturing companies, Rock Island and Davenport, are virtually identical in all aspects of their

Question:

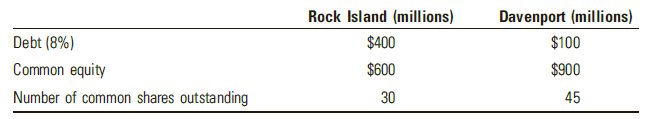

Two capital goods manufacturing companies, Rock Island and Davenport, are virtually identical in all aspects of their operations—product lines, amount of sales, total size, and so on. The two companies differ only in their capital structures, as shown here:

Each company has $1 billion in total assets. Capital goods manufacturers typically are subject to cyclical trends in the economy. Suppose that the EBIT level for both companies is $100 million during an expansion and $60 million during a recession. (Assume a 40% tax rate for both companies.)

a. Calculate the earnings per share for both companies during expansion and recession.

b. Which stock is riskier? Why?

c. At what EBIT level are the earnings per share of the two companies

identical?

d. Calculate the common stock price for both companies during an expansion if the stock market assigns a price-to-earnings ratio of 10 to Davenport and 9 to Rock Island.

Step by Step Answer:

Contemporary Financial Management

ISBN: 978-1337090582

14th edition

Authors: R. Charles Moyer, James R. McGuigan, Ramesh P. Rao